Las Vegas Hotel Sales Plummet: What Smaller Investors Can Learn from This Market Shift

Las Vegas Hotel Sales Plummet: What Smaller Investors Can Learn from This Market Shift

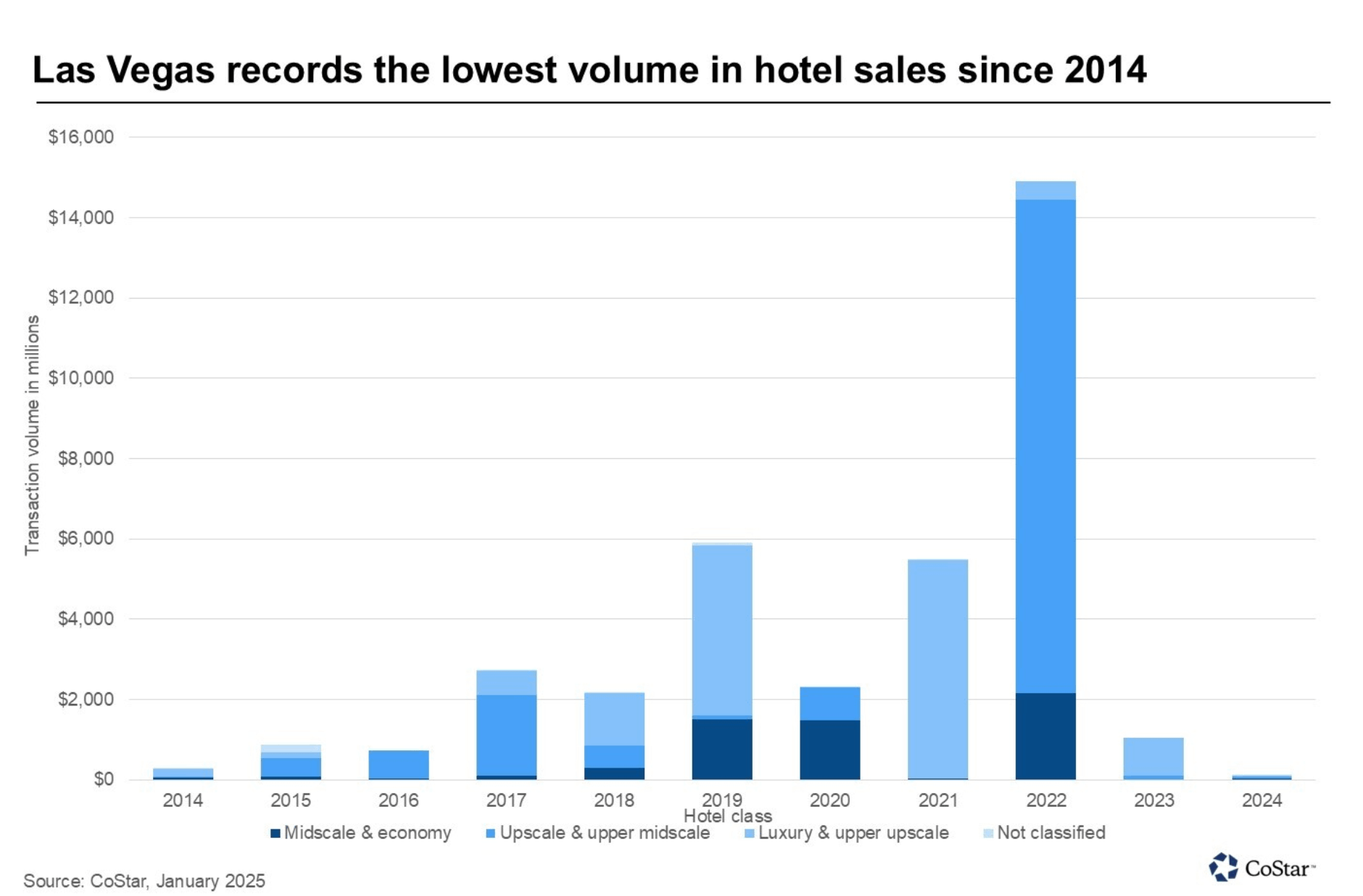

In 2024, Las Vegas hotel sales hit their lowest level in over a decade, with fewer than 10 properties changing hands and total sales volume plunging to $115 million—a staggering 90% drop from 2023’s $1 billion.

For small-scale investors focusing on multifamily or mixed-use properties, this sharp downturn in the hotel sector offers key lessons on market cycles, financing challenges, and emerging opportunities.

Las Vegas Hotel Sales in 2024: A Historic Decline

Breaking Down the Numbers

📉 2024 Total Sales Volume: $115 million (Down 90% from 2023)

🏨 Number of Transactions: Fewer than 10

💰 Largest Sale: Rodeway Inn & Suites ($27 million)

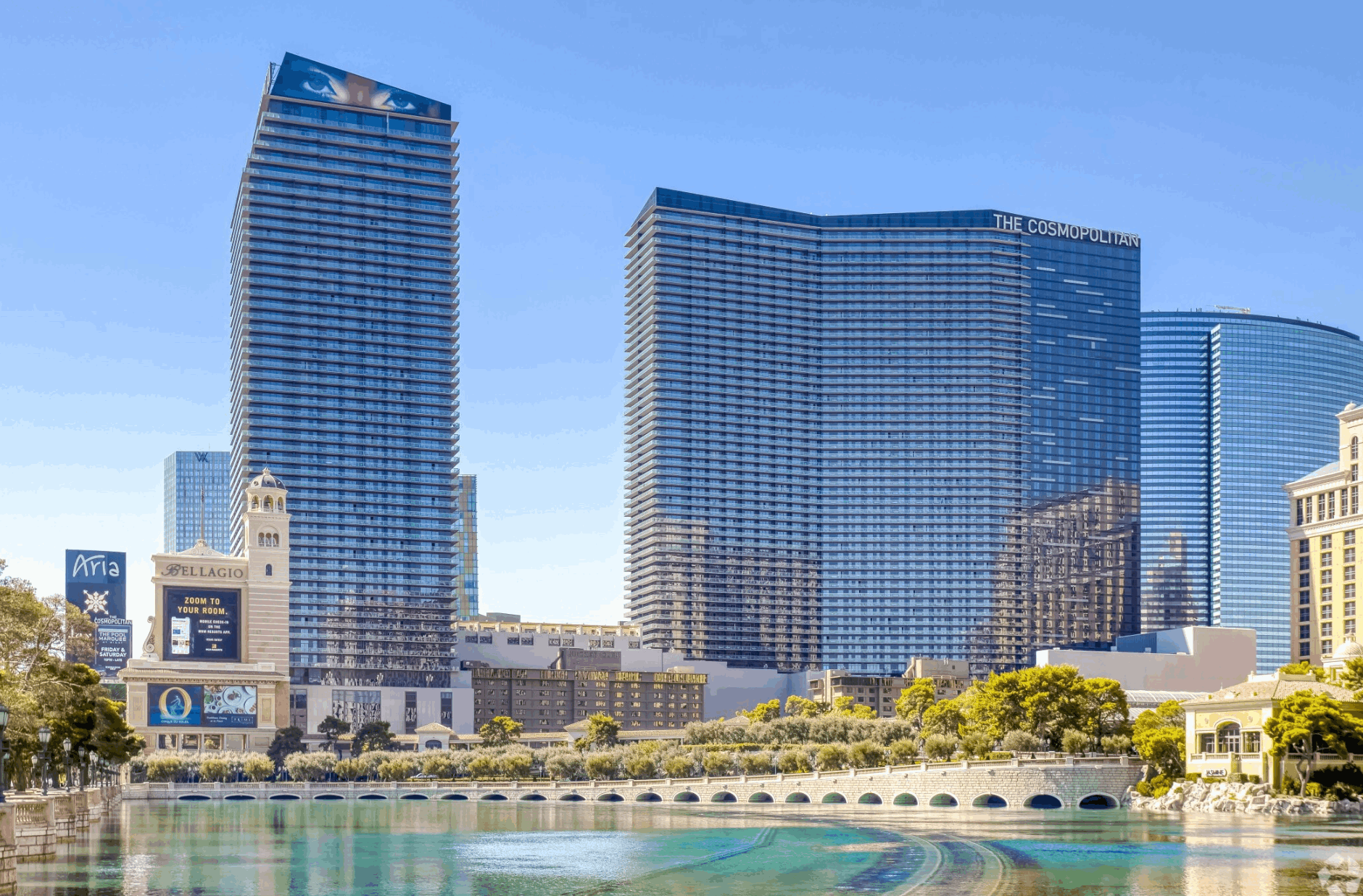

Compare this to 2023, when the Bellagio partially sold for $950 million as part of a $5.1 billion valuation, and it’s clear that big-ticket transactions have vanished.

Why Are Las Vegas Hotel Sales Slowing?

The slowdown can be attributed to three main factors:

1️⃣ Rising Interest Rates – Higher borrowing costs have made financing large deals far more expensive.

2️⃣ Lack of Institutional Buyers – Institutional investors, who typically drive portfolio sales, have pulled back.

3️⃣ Absence of Major Portfolio Deals – Unlike 2022’s $14.8 billion Vici Properties acquisition of MGM Growth Properties, 2024 has seen no large-scale purchases.

Key Takeaways for Smaller Investors

While hotel sales have slowed, smaller investors can still find opportunities—especially in multifamily and mixed-use properties.

1. Market Cycles Matter—Adaptability is Key

The hotel sector’s slowdown underscores how interest rates and macroeconomic conditions impact real estate. Smaller investors should stay flexible and look for opportunities in less competitive asset classes.

2. 1031 Exchanges Still Offer Tax Advantages

One bright spot in 2024’s biggest sale—the $27 million Rodeway Inn & Suites deal—was that it was executed using a 1031 exchange.

🔹 What is a 1031 Exchange?

A 1031 exchange allows investors to defer capital gains taxes by reinvesting proceeds from one property into another like-kind investment.

✅ How This Applies to Small Investors:

•You don’t need a $27M deal—1031 exchanges are commonly used for duplexes, triplexes, and fourplexes.

•Reinvest strategically into higher-growth properties with strong fundamentals.

3. Multifamily & Mixed-Use Properties Remain Resilient

With interest rates expected to gradually decrease in 2025, smaller investors who position themselves early in high-demand multifamily properties could capitalize on future appreciation.

🔹 Key Investment Considerations:

•High rental demand locations

•Value-add opportunities (renovations, improved management)

•Financing options—monitor interest rate shifts for better borrowing conditions

What’s Next? The 2025 Outlook for Small Investors

💡 Interest rates may decrease in 2025, potentially reigniting investor activity.

💡 Institutional players may return, but smaller investors can move first in overlooked asset classes.

💡 Multifamily properties could see renewed demand, creating stronger cash flow opportunities.

For investors considering reinvestment strategies or 1031 exchanges, now is the time to prepare.

Need Expert Guidance on Your Next Investment?

At Hyde Real Estate Group, we help investors navigate market shifts, 1031 exchanges, and portfolio expansion strategies. Whether you’re looking for:

✅ Tax-efficient reinvestment opportunities

✅ Multifamily properties with strong fundamentals

✅ Market insights on Las Vegas real estate trends

📞 Contact us today for tailored advice and property insights.

🔗 Learn More: CoStar Market Report

Frequently Asked Questions (FAQs)

1. Why did Las Vegas hotel sales drop so sharply in 2024?

The decline is mainly due to higher interest rates and the absence of major institutional portfolio deals, which typically drive high transaction volumes.

2. What was the biggest hotel sale in Las Vegas in 2024?

The largest sale was the Rodeway Inn & Suites, a 150-room economy-class hotel, which sold for $27 million.

3. How can smaller investors benefit from this market shift?

Smaller investors can take advantage of decreased competition in multifamily and mixed-use properties while institutional investors sit on the sidelines.

4. What is a 1031 exchange, and how does it work?

A 1031 exchange allows investors to defer capital gains taxes by reinvesting in another like-kind property. It’s commonly used in residential and commercial real estate.

5. Will interest rates go down in 2025?

While predictions vary, many experts expect rates to gradually decrease, making financing more attractive for investors.

6. How can I find good investment opportunities in Las Vegas right now?

Focusing on multifamily properties with high rental demand and value-add potential is key. Consulting a real estate expert can help identify the best deals.

Final Thoughts: Position Yourself for 2025’s Opportunities

The Las Vegas hotel sector’s slowdown is a reminder of how market cycles impact all asset classes. Smaller investors who stay flexible, leverage 1031 exchanges, and focus on strong fundamentals will be best positioned for future opportunities.

📢 Want to stay ahead of the market? Reach out to our team for expert insights on where to invest next.

🔗 Read More: CoStar Market Report

Categories

Recent Posts

GET MORE INFORMATION