The 2025 Multifamily Market Outlook: What Investors Should Know

The 2025 Multifamily Market Outlook: What Investors Should Know

The multifamily housing market in 2025 will navigate economic headwinds, but opportunities for investors remain strong. According to Freddie Mac’s 2025 multifamily outlook, while higher vacancies, slower rent growth, and interest rate volatility will create short-term challenges, the long-term fundamentals of multifamily real estate remain solid due to strong rental demand and a shortage of affordable housing.

For investors looking to strategically position themselves, understanding key market trends and regional variations is crucial.

Market Trends to Watch in 2025

1. Rebounding Multifamily Loan Originations

•Multifamily lending activity stalled in 2023-2024 due to interest rate fluctuations and property value corrections.

•Freddie Mac projects that loan volume will reach $370–$380 billion in 2025—up from $320 billion in 2024.

•Stabilizing interest rates and improved market confidence will drive lending recovery.

💡 Investor Insight: Refinancing and acquisition financing opportunities will improve—investors should secure loans before rates shift again.

👉 Source: CoStar Multifamily Loan Report

2. Shifting Supply and Demand Dynamics

•New apartment construction hit record highs in 2023-2024, creating short-term oversupply in some markets.

•In 2025, new multifamily completions will drop by more than 50%, rebalancing supply and demand.

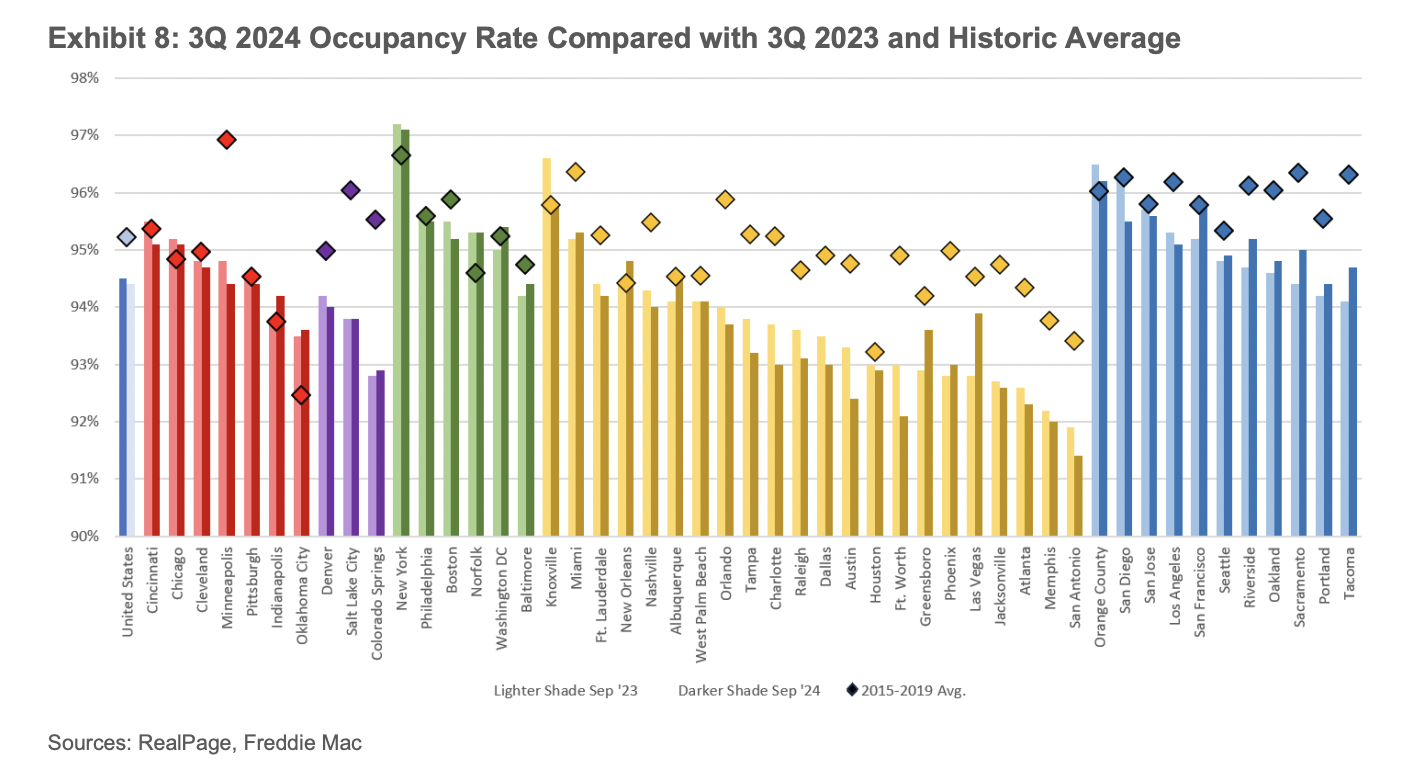

•Vacancy rates are expected to rise to 6.2%, slightly above the long-term average of 5.5%.

•National rent growth is forecasted at 2%, significantly lower than the 5-6% growth rates seen in 2021-2022.

💡 What This Means: Investors should focus on stabilized properties in markets with steady demand rather than high-growth speculative areas.

👉 Source: Freddie Mac 2025 Multifamily Outlook

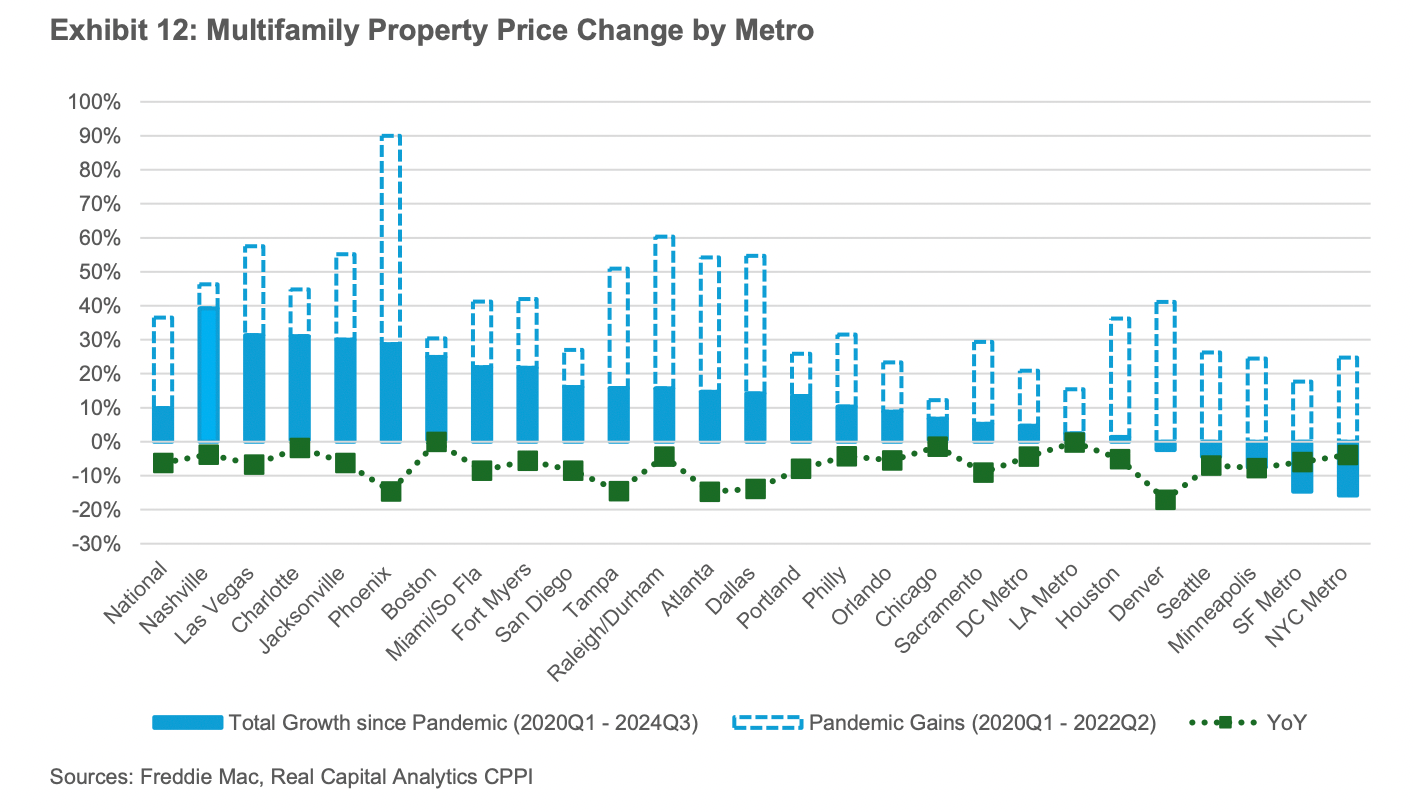

3. Geographic Performance Variations

•Secondary and tertiary markets will outperform oversupplied Sun Belt and Mountain West cities.

•Top-performing markets in 2025 include:

✅ Oklahoma City: Expected gross rental growth of 4.4% or higher.

✅ New Orleans: Strong rental demand due to limited new supply.

•Markets facing headwinds due to high construction volume include:

❌ Austin

❌ Phoenix

❌ Denver

💡 Strategy for Investors: Seek markets with controlled supply growth to avoid high vacancy risks.

4. Continued Investor Interest in Multifamily Assets

•Despite rising vacancies, multifamily remains a preferred asset class due to:

✔ Rising homeownership costs pushing more demand toward rentals.

✔ A slower pace of new apartment deliveries, reducing supply pressure.

✔ Long-term stable returns, even in uncertain economic conditions.

💡 What This Means: Investors should prioritize long-term stability over short-term volatility.

What This Means for Las Vegas and the Southwest

As part of the Sun Belt region, Las Vegas will face some short-term hurdles, including:

•Higher vacancy rates due to new supply hitting the market.

•Slower rent growth compared to previous years.

However, Las Vegas remains a strong long-term bet due to:

✔ Population Growth – Las Vegas continues to attract new residents and businesses.

✔ Affordability – Compared to California and other West Coast metros, Las Vegas offers lower living costs.

✔ Proximity to Jobs & Entertainment – A major draw for young professionals and renters.

💡 Investor Strategy: Focus on stabilized, cash-flowing properties with high occupancy rates to weather short-term fluctuations.

Position Yourself for Success in 2025

With the multifamily market adapting to changing conditions, investors need to act strategically to capitalize on opportunities.

Steps to Take Now:

🔹 Explore new acquisitions in high-demand secondary markets.

🔹 Refinance assets to secure favorable loan terms.

🔹 Analyze vacancy trends and prioritize stabilized properties.

🔹 Leverage experienced real estate and financing partners.

At Hyde Real Estate Group, we specialize in:

✔ Helping investors identify high-performing multifamily assets.

✔ Connecting clients with top-tier financing partners.

✔ Navigating the complexities of market shifts for long-term success.

📩 Ready to secure your next investment? Contact Hyde Real Estate Group today to explore exclusive opportunities and financing solutions tailored for 2025!

Frequently Asked Questions (FAQs)

1. Is 2025 a good year to invest in multifamily properties?

Yes. While short-term challenges like higher vacancies exist, long-term fundamentals remain strong, making 2025 a strategic buying opportunity.

2. How will interest rates impact multifamily investments in 2025?

Stabilizing interest rates will make multifamily loan originations more attractive, leading to a rebound in investment activity.

3. What cities will perform best for multifamily investments in 2025?

Cities with limited new supply, such as Oklahoma City and New Orleans, are projected to outperform oversupplied Sun Belt markets like Austin and Phoenix.

4. Will rent growth continue in 2025?

Yes, but at a slower pace (2%), compared to the rapid rent increases seen in 2021-2022.

5. How does Las Vegas compare to other Sun Belt markets?

Las Vegas has strong long-term fundamentals, but investors should be selective with asset choices due to new supply pressures in 2025.

6. What should multifamily investors focus on in 2025?

Stable, high-occupancy properties and markets with balanced supply and demand offer the best risk-adjusted returns.

Final Thoughts

The 2025 multifamily market presents both challenges and opportunities. While vacancy rates may rise and rent growth may slow, the long-term fundamentals of multifamily investing remain strong.

💡 Key Takeaways for Investors:

✅ Secure financing early to take advantage of rebounding loan originations.

✅ Prioritize stabilized properties in markets with controlled supply.

✅ Look beyond short-term volatility—the fundamentals of multifamily investing remain solid.

📩 Looking for expert guidance? Contact Hyde Real Estate Group today to maximize your investment strategy in 2025!

Categories

Recent Posts

GET MORE INFORMATION