National Multifamily Trends — How They Affect All Asset Classes in Las Vegas

📉 National Multifamily Trends — How They Affect All Asset Classes in Las Vegas

Dear Investors,

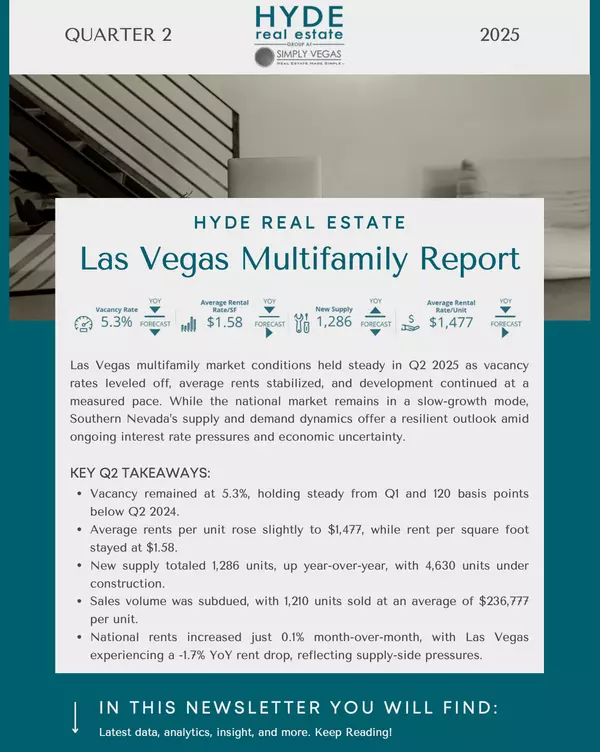

As we move through the second half of 2025, the latest data from Yardi Matrix paints a clearer picture of what’s ahead for the multifamily sector nationwide — and what it means for us here in Las Vegas.

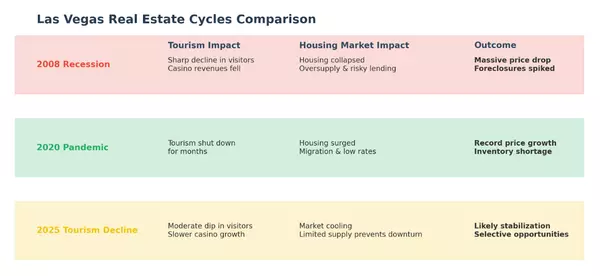

This year’s story is all about balance: between supply and demand, rent growth and affordability, and strategy versus timing. For Las Vegas investors, now is a moment to take stock, stay tactical, and position for long-term success.

🌡 Multifamily Rent Growth Is Cooling — But Not Collapsing

Nationally, advertised multifamily rent growth is softening — up just 1.2% in the first half of the year, with full-year growth likely to remain under 2% . Las Vegas, which rode the wave of aggressive rent spikes in 2021–2022, is now experiencing a modest correction: rents are down 1.1% year-over-year and projected to finish 2025 slightly negative at -0.4% .

But this trend isn’t impacting all asset classes equally.

🏢 Class B and C Assets Showing Resilience

Higher-end “Lifestyle” Class A assets — typically newer, luxury-oriented communities — are facing the brunt of the pressure. These properties are more exposed to lease-up competition and rent elasticity, especially in oversupplied submarkets.

Class B and C properties, however, are showing greater rent stability and consistent occupancy. That’s because these assets cater to renters by necessity — working-class households, service industry employees, and fixed-income tenants — many of whom are priced out of the for-sale market and even Class A rentals.

In Las Vegas, this segment of the market continues to benefit from:

- Limited new Class B/C development (most new supply is luxury)

- Consistent demand driven by affordability

- Downward migration from renters trading down from higher-priced units

In short, Class B and C properties are less exposed to supply-driven rent compression and are often positioned to outperform in flatter or declining rent environments.

🏘️ SFR Portfolios: A Strategic Hedge Against Multifamily Headwinds

While traditional multifamily rent growth cools, single-family rental (SFR) portfolios are quietly outperforming. In Las Vegas, SFR rents are up 1.3% year-over-year, and national occupancy remains healthy near 94.9% .

Why does this matter?

- SFR demand is structurally strong: It caters to families seeking more space and privacy who can’t afford to buy.

- There’s very little new SFR supply compared to multifamily.

- Institutional capital is actively expanding in this segment, signaling confidence in long-term performance.

For multifamily investors looking to diversify, building or acquiring a portfolio of BTR (build-to-rent) product in the Las Vegas Valley can provide insulation against urban Class A oversupply while benefiting from renter demand that’s shifting toward suburban and family-friendly options.

📦 Supply Matters — And Vegas Is Still Absorbing

Las Vegas added nearly 5% to its multifamily inventory in the past few years. In 2025, 4,804 more units are expected to deliver, or 2.5% of the market’s stock . That’s a significant amount of new supply in a short time, and it will continue to weigh on Class A performance.

Yet demand remains steady, especially in the affordable and mid-tier segments. Investors who target Class B/C assets or SFRs are better positioned to capture durable income during this period of rebalancing.

💼 Strategic Recommendations for Investors

Here’s how we’re advising clients in today’s environment:

✔ Focus on asset class segmentation — Favor Class B and C properties in high-occupancy submarkets with limited direct competition.

✔ Be patient but proactive — Use this cooling period to buy assets below replacement cost with room to renovate or reposition.

✔ Explore SFR and BTR — Build-to-rent is emerging as a long-term outperformer. Consider adding or scaling SFR portfolios as a hedge.

✔ Track supply timelines — Construction starts are falling sharply. Deliveries will slow beginning in 2026, setting up the next rent growth cycle by 2027–2028 .

🧭 Final Takeaway: Timing and Asset Selection Will Define Success

The Las Vegas multifamily market isn’t broken — it’s simply adjusting after several years of rapid growth and heavy supply. Class B and C properties continue to offer dependable returns, while SFR portfolios provide a forward-looking way to stay ahead of evolving renter preferences.

If you’d like to explore specific submarkets, Class B/C opportunities, or new SFR strategies across the Vegas Valley, we’d be happy to share insights tailored to your portfolio.

Best regards,

Catherine Hyde

HYDE Real Estate Group

www.hyderealestate.com

Categories

Recent Posts

GET MORE INFORMATION