Las Vegas Rental Market Update – Spring 2025: National Trends, Tariff Impacts & Local Opportunities

🌆 Las Vegas Rental Market Update – Spring 2025: National Trends, Tariff Impacts & Local Opportunities

As we move into Q2 of 2025, the U.S. rental market continues to evolve, influenced by economic shifts, construction dynamics, and regional demand. According to Realtor.com’s March 2025 Rent Report, we are witnessing the 20th straight month of year-over-year rent declines nationally, while Las Vegas stands out with rent increases bucking the trend.

Let’s dive into the data, explore the new tariff policies affecting housing, and highlight what this means for renters, landlords, and investors in the Las Vegas Valley.

📉 National Snapshot: Rents Continue to Cool

Across the 50 largest metro areas:

- The median asking rent fell to $1,694, down 1.2% year-over-year.

- Studio and 1-bedroom units saw sharper drops (-1.4% and -2.2%, respectively).

- 2-bedroom rents held more steady, with a slight 0.5% annual increase.

The cooling trend is attributed to a growing multifamily construction pipeline, loosening inventory, and some softening in rental demand after years of steep growth.

📌 Source: Realtor.com, March 2025 Rent Report

⚠️ Tariff Impact: Higher Costs for New Multifamily Projects

One of the most critical developments this year is the tariff expansion on building materials, particularly those imported from China, Canada, and Mexico. These include:

- Steel and aluminum used in structural framing

- Finish materials like cabinetry, lighting fixtures, and tile

This policy shift is driving up construction costs for new multifamily developments across the U.S., which will slow the pace of new unit deliveries later in the year.

💡 Markets with the fastest-growing multifamily permits—such as Phoenix, Austin, and Las Vegas—are expected to feel the sharpest impact from these rising material costs. These cities had previously relied on strong supply growth to moderate rent prices, but that cushion may shrink.

📌 Source: Realtor.com March 2025 Rent Report

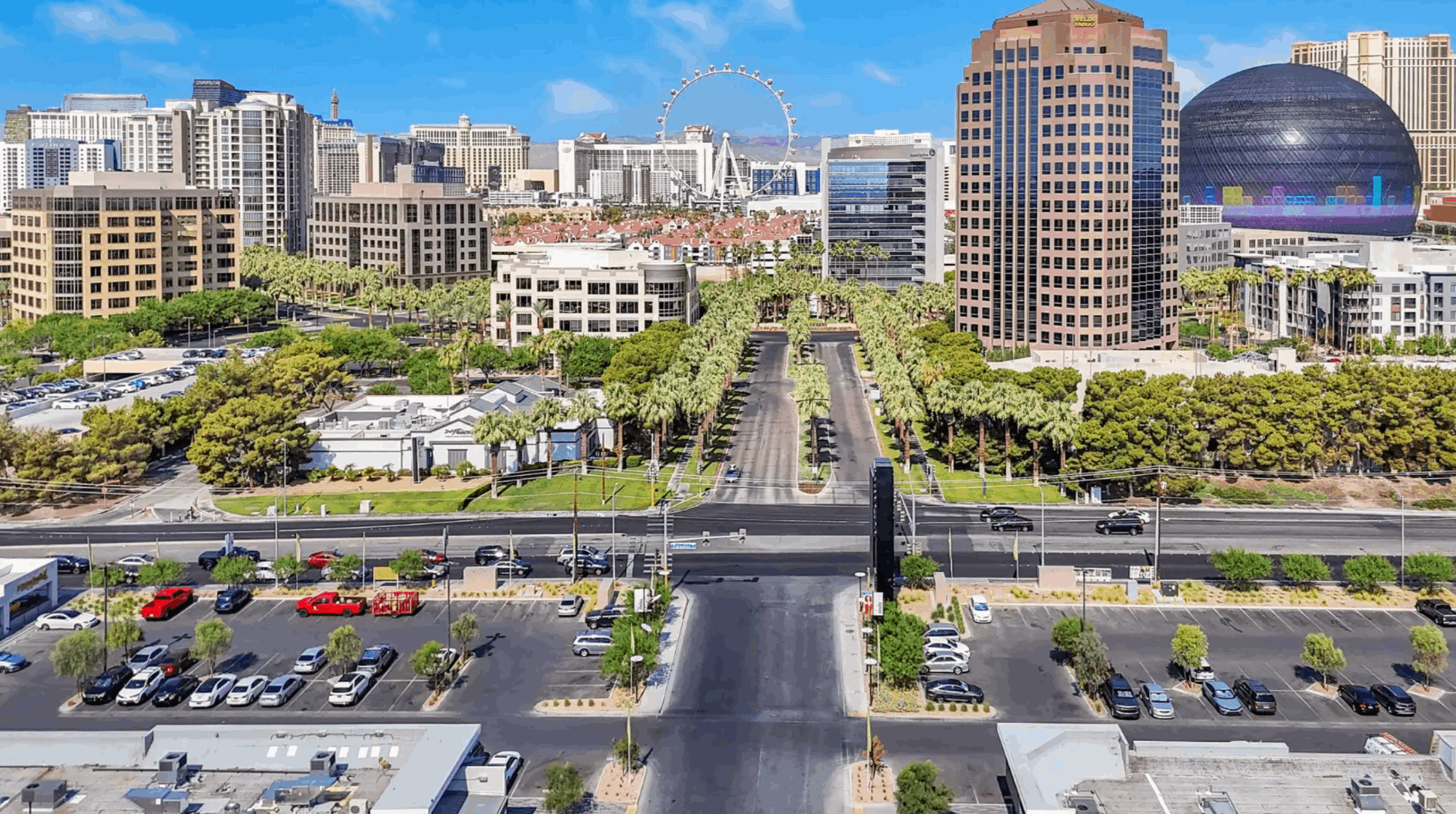

📈 Las Vegas Market: Rents Rise Amid Supply Strain

Las Vegas diverges from the national trend:

- Median asking rent: $1,738

- Year-over-year increase: 2.9%

- Inventory tightening: Available rental homes dropped from 2,400 to 2,150 in just one month.

- Leased units increased from 1,400 to 1,500, pushing months of inventory down from 1.7 to 1.5.

🔍 What’s Driving the Local Rise?

- Strong inbound migration from higher-cost states like California

- Limited new supply, now worsened by tariffs on materials

- A backlog of new projects that may get delayed or repriced

📌 Source: Rice Real Estate, March 2025 Report

🏘️ Implications for Las Vegas Stakeholders

For Renters:

Expect more competition and continued upward pressure on prices, especially for quality single-family rentals or well-located units near the Strip, Summerlin, or Henderson.

For Landlords:

This is an advantageous time to lease or reprice units. With construction delays looming, existing inventory will be in higher demand.

For Investors:

Despite national rent softness, Las Vegas remains a growth market, with positive rental trends and a demographic tailwind. Smart investors should monitor:

- Tariff effects on future cap-ex budgets

- Delays in construction completion

- Value-add opportunities in underpriced Class B/C assets

📝 Final Takeaway

While much of the country is seeing rent relief, Las Vegas is defying the trend, bolstered by strong demand, low inventory, and now, supply-side shocks from tariffs. Multifamily construction may slow, but that positions existing properties to hold and increase value.

This is a crucial time for strategic leasing, intelligent acquisitions, and keeping a close eye on policy shifts that ripple through housing costs.

If you’d like to review rental comps, explore acquisition opportunities, or assess how your investment strategy aligns with current trends, don’t hesitate to reach out.

Frequently Asked Questions (FAQs)

1. Are rents going up or down in Las Vegas in Spring 2025?

Unlike national trends, Las Vegas rents are increasing. The median asking rent rose 2.9% year-over-year to $1,738 due to tight supply and strong migration .

2. What’s driving rental growth in Las Vegas?

Key drivers include inbound migration from high-cost states, limited new supply, and delays in multifamily construction due to material tariffs .

3. How are tariffs affecting the rental market?

New tariffs on steel, aluminum, and building materials are raising construction costs, slowing new multifamily projects, and tightening rental inventory .

4. What does this mean for renters in Las Vegas?

Renters should expect more competition and rising prices, especially in high-demand areas like Henderson, Summerlin, and near the Strip .

5. Is this a good time for landlords to reprice or lease units?

Yes. The current environment favors landlords as supply tightens and demand remains high, creating opportunities for repricing and reducing vacancy .

6. Should investors still consider Las Vegas for rental property?

Absolutely. Despite national softness, Las Vegas is a growth market with rising rents and strong long-term fundamentals, making it attractive for buy-and-hold strategies .

Categories

Recent Posts

GET MORE INFORMATION