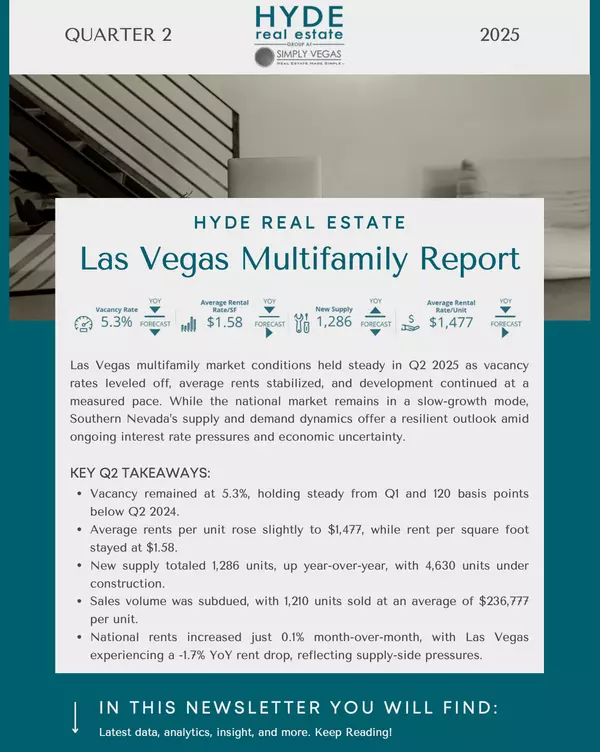

The Next Window: Why Las Vegas Multifamily Is Poised for Its Second Act

Las Vegas Multifamily Is Back: Why 2025–2029 Is the New Investor Window

Many investors believe they missed the boat on Las Vegas multifamily. The truth? The next big window is just opening. With stabilized pricing, shrinking supply, and institutional capital returning, the conditions are lining up for a powerful second act.

📉 The “Missed the Moment” Myth

Multifamily values have already corrected—down 30–35% from peak pricing. Like in 2009–2011, this reset has laid the foundation for a new growth cycle.

In Las Vegas, the rebound is stronger due to:

-

Twice the national population and job growth rate

-

Tighter construction starts (down 70% nationally)

-

Assets trading well below replacement cost

Translation? Las Vegas is now priced near intrinsic value with limited downside and clear upside.

🔄 The Asymmetric Setup

According to Virtú Investments, we’re in a period of “structural asymmetry”—a rare cycle with:

-

Limited downside (prices at or below replacement cost)

-

Constrained new supply for the next 2–3 years

-

Rising capital inflow as institutions return to the market

That creates a unique opportunity where investors can enter safely now and scale value fast as rents rise.

📈 The 2026–2029 Catalyst Phase

By 2026:

-

Multifamily supply bottoms out nationally

-

Las Vegas will lead the recovery, thanks to fast lease-up absorption and steady in-migration

-

Construction inflation will keep new builds expensive, preserving pricing power for existing assets

This is a rare convergence: rising rents, low inventory, and assets trading at a discount.

💼 The Investor Opportunity Today

Investors entering now can benefit from:

-

Rent normalization and lease-up absorption

-

Cap rate compression as capital flows back in

-

Appreciation toward replacement cost = built-in equity upside

This isn’t speculation—it’s strategic timing based on real supply, demand, and cost dynamics.

🧠 Bottom Line

Las Vegas multifamily isn’t past its prime—it’s priced for expansion.

At HYDE Real Estate Group, we’re helping clients secure:

-

Discounted fourplexes and small apartment buildings

-

Off-market opportunities before the next wave of institutional demand hits

-

Assets positioned to cash flow now and appreciate fast over the next cycle

If you missed the last run, don’t miss this one.

🙋♀️

FAQs: Las Vegas Multifamily Investment Outlook

1. Have multifamily values really corrected?

Yes—30–35% down from peak levels in most markets, including Las Vegas.

2. Is there still too much supply?

Not anymore. Starts are down 70%+, and completions will drop sharply by 2026.

3. Is this another speculation cycle?

No. It’s a disciplined return to intrinsic value backed by structural fundamentals.

4. What’s the benefit of buying now?

You can capture the next full up-cycle, including rent growth, price appreciation, and yield compression.

5. Is institutional capital coming back?

Yes—transaction volume is up 22%, and Las Vegas offers higher yields than coastal markets.

6. What kind of properties make sense now?

Class B/C multifamily buildings with stable cash flow and room for rent normalization.

Categories

Recent Posts

GET MORE INFORMATION