Las Vegas Shines as a West Coast Leader Amid America's Aging Housing Crisis

Las Vegas Shines as a West Coast Leader Amid America's Aging Housing Crisis

A new Redfin report released in May 2025 sheds light on a growing issue in the American housing market: the aging inventory of homes. As of now, the median age of U.S. homes has climbed to 43 years—the oldest on record. With more than half of the nation’s housing stock built before 1980 and new construction struggling to keep pace with demand, buyers and renters alike are feeling the pinch.

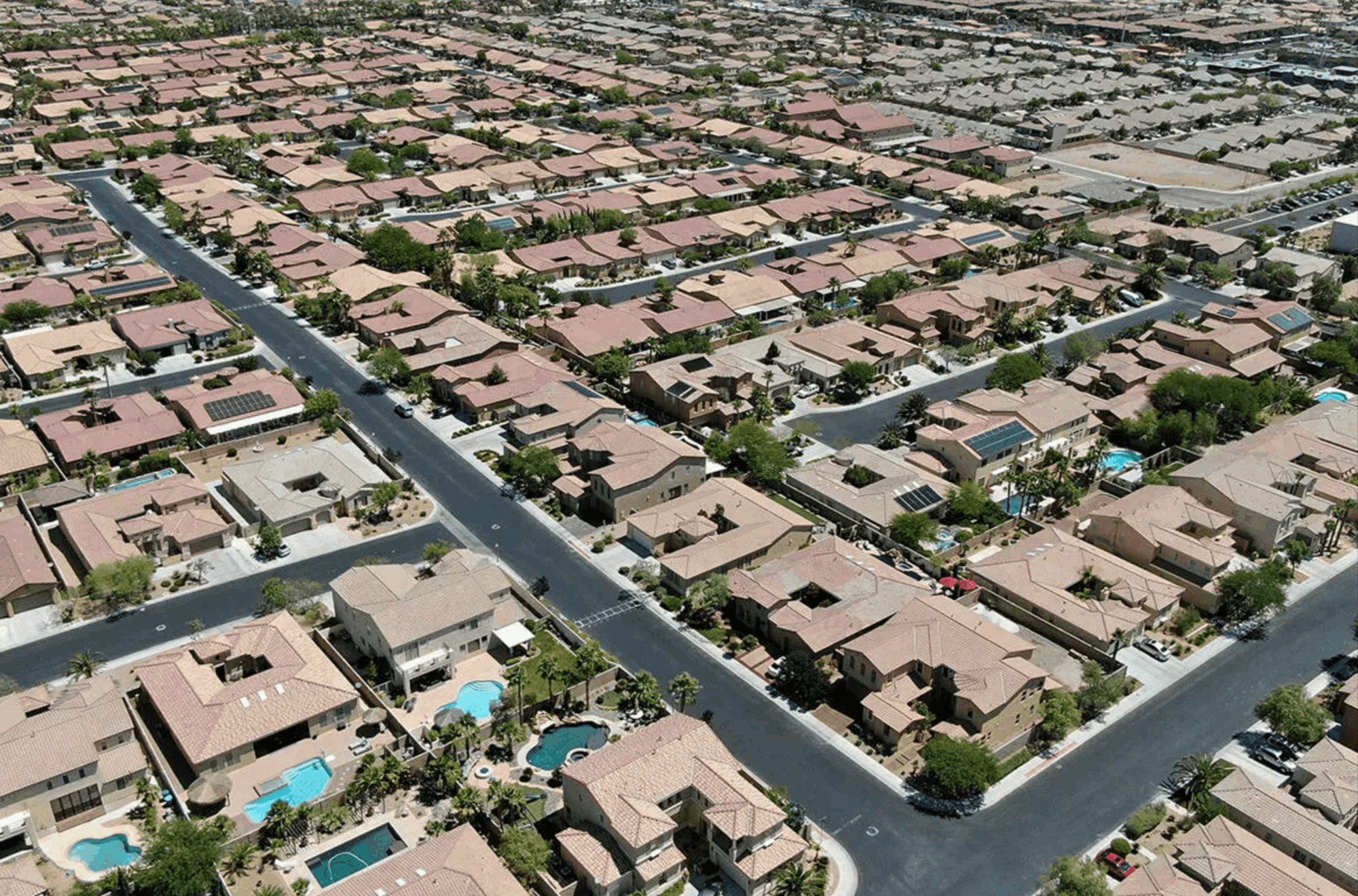

This national trend is creating headwinds in many major metros, especially in older East Coast cities where housing stock is aging faster than it can be replaced. However, Las Vegas stands apart as a beacon of opportunity for both residents and investors navigating this historic shortage.

Why Las Vegas Stands Out:

- Newer Inventory: Unlike older urban centers, much of Las Vegas’ residential construction boom occurred after 1990, with steady development continuing into the 2000s and beyond. This gives the city a fresher, more modern housing inventory that's better suited to today’s standards.

- Active Construction Pipeline: Las Vegas continues to lead the West in housing development. From suburban subdivisions to infill multifamily projects, the city is responding to demand with forward-thinking growth.

- Investor-Ready Properties: A large share of Las Vegas’ housing is turnkey or lightly updated, making it an attractive market for buyers seeking cash flow with minimal renovation risk.

- High Quality of Life: In addition to housing advantages, residents enjoy abundant sunshine, no state income tax, and proximity to major markets like Los Angeles and Phoenix without the overcrowding and cost.

An Investment-Savvy Move

For investors, Las Vegas offers the rare combination of relatively young housing stock, consistent population growth, and a pro-development culture. Whether you're looking to scale a portfolio or secure a home that won't break the bank or require a full gut-renovation, Las Vegas is increasingly a market of choice.

As aging inventory challenges grow nationwide, smart buyers are setting their sights on metros where newer housing isn't just a perk—it's the norm. Las Vegas is not just keeping up; it's setting the pace.

Visit our website or contact us today to review your portfolio with personalized guidance and explore exclusive off-market opportunities tailored to your goals.

Frequently Asked Questions (FAQs)

1. Why is aging housing a concern in the U.S. in 2025?

The median age of homes nationally is 43 years, with over half built before 1980, creating challenges in maintenance, energy efficiency, and livability .

2. How does Las Vegas differ from other aging housing markets?

Las Vegas has a significantly younger housing stock, with most homes built after 1990, making it more modern, efficient, and appealing to today’s buyers and renters .

3. Is there still new construction happening in Las Vegas?

Yes. The city leads the West in housing development, including suburban subdivisions and infill multifamily projects, helping to meet rising demand .

4. Why is Las Vegas ideal for real estate investors right now?

Many properties are turnkey or lightly updated, reducing renovation risk and offering solid rental yields in a growing metro with strong fundamentals .

5. How does the city’s housing quality impact its affordability?

Newer homes mean lower maintenance costs and greater energy efficiency, making them more attractive and cost-effective for residents over time .

6. What makes Las Vegas a future-proof investment?

A combination of new housing, steady population growth, and a pro-development environment makes it a leading choice for long-term real estate success .

Categories

Recent Posts

GET MORE INFORMATION