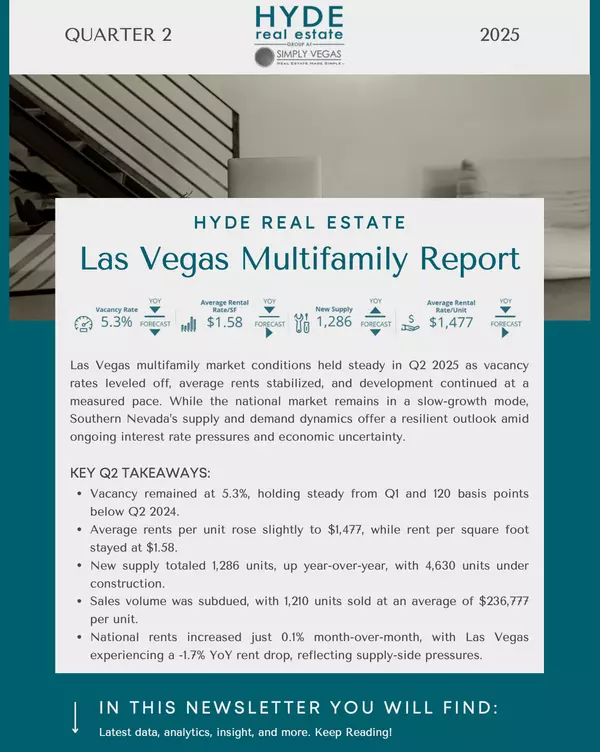

Lease-Ups Accelerate in South and Outlying Las Vegas — What Investors Should Know

Lease-Ups Accelerate in South and Outlying Las Vegas — What Investors Should Know

If you’re chasing the hottest investment trends in Las Vegas real estate, look beyond the Strip. New data reveals that multifamily properties in South Las Vegas and outlying suburban areas like Henderson and Skye Canyon are leasing up significantly faster than those in the urban core.

📊 What the CoStar Report Found

According to CoStar:

-

73% of new units leased in 2024–2025 were in outlying submarkets

-

Southern Highlands, Inspirada, and Skye Canyon outpaced downtown Las Vegas in lease-up speed

-

Tenants favor modern suburban living with schools, open space, and newer infrastructure

🎯 Why Lease-Ups Are Faster in the Suburbs

Post-pandemic preferences have shifted renter behavior toward quality-of-life factors. Tenants are now prioritizing:

-

Access to good schools

-

Less traffic and more parking

-

Newer retail centers and parks

-

Lower crime and more space

Simply put: families and professionals are choosing suburban calm over urban chaos.

🔑 What This Means for Investors

Whether you’re holding, buying, or building, this trend delivers big insights.

For Current Owners

-

Properties in Spring Valley, Southern Highlands, or Henderson may be undervalued relative to demand

-

Minor upgrades (exterior refreshes, amenity boosts) can lead to faster leasing and higher rents

-

Tenants in these areas show longer retention, improving ROI

For New Buyers

-

Class B and low-density assets in the southern and western submarkets have high absorption + low carry risk

-

Suburban zones are offering Class A renters at Class B pricing

-

Mid-size investments like duplexes and fourplexes are ideal entry points

📍 Submarkets Showing Strongest Momentum

|

Submarket |

Why It’s Hot |

|---|---|

|

Southern Highlands |

High-rated schools, master-planned appeal |

|

Skye Canyon |

Newer construction, open space, mountain views |

|

Henderson (South/West) |

Lower crime, stable employment |

|

Enterprise |

Great for remote workers and dual-income households |

These areas reflect the broader trend: renters are driving OUT from the core—and investors should follow them.

🧭 Hyde Real Estate Group’s Strategic Playbook

We help investors like you:

-

Identify high-demand submarkets

-

Reposition mid-tier properties

-

Find off-market fourplexes with rapid lease-up performance

2025 is not the year to chase only downtown deals. It’s the year to go where the tenants are going.

🙋♂️

FAQs: Investing in South & Suburban Las Vegas in 2025

1. Why are suburban Las Vegas properties leasing faster?

Tenants want newer properties, better schools, and less congestion—factors more common in areas like Henderson and Skye Canyon.

2. What types of properties are performing best?

Newer Class B buildings, small multifamily homes, and duplexes in suburban areas are leasing quickly and retaining tenants longer.

3. Is this trend better than investing near the Strip?

Not necessarily “better,” but it’s lower-risk with more stable renters and less turnover, especially for long-term holds.

4. Where should I look to invest now?

Focus on Southern Highlands, Skye Canyon, Henderson (West/South), and Enterprise for high-absorption and family-friendly tenants.

5. How can I add value to existing properties?

Light remodels, exterior upgrades, and improved property management often deliver solid ROI without large capital expenses.

6. Will rent prices rise in these areas?

Yes. Suburban demand is fueling steady rent increases, and many of these submarkets remain undervalued by national investors.

Categories

Recent Posts

GET MORE INFORMATION