Las Vegas Tourism Slows in 2025—But Here’s Why That’s Good for Smart Real Estate Investors

Las Vegas Tourism Slows in 2025—But Here’s Why That’s Good for Smart Real Estate Investors

A recent slowdown in Las Vegas tourism numbers has caught some attention. But before assuming a market crash is near, savvy investors and buyers need to dig deeper—because this dip might actually be a buying opportunity.

📉 Tourism Doesn’t Dictate Housing

Yes, Las Vegas is known for its tourism and gaming industries—but housing cycles aren’t solely tied to visitor traffic.

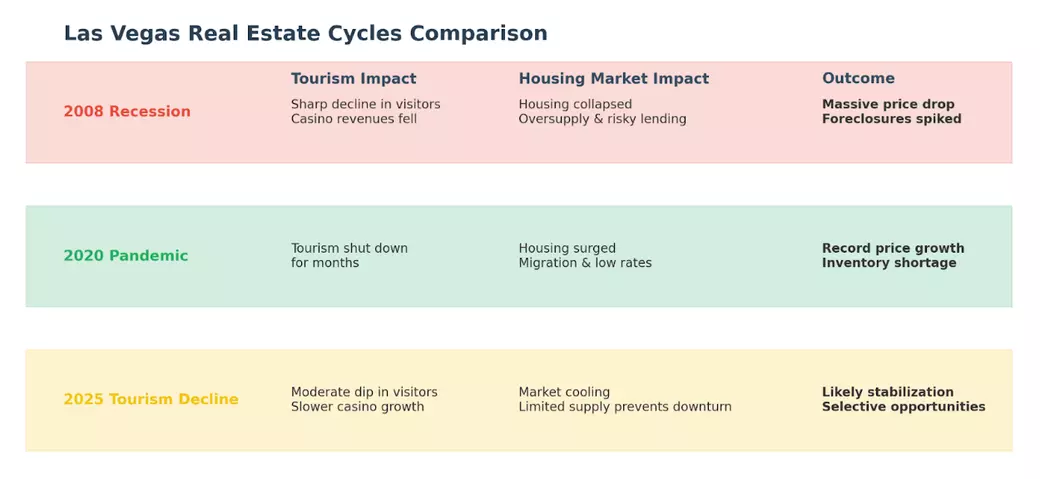

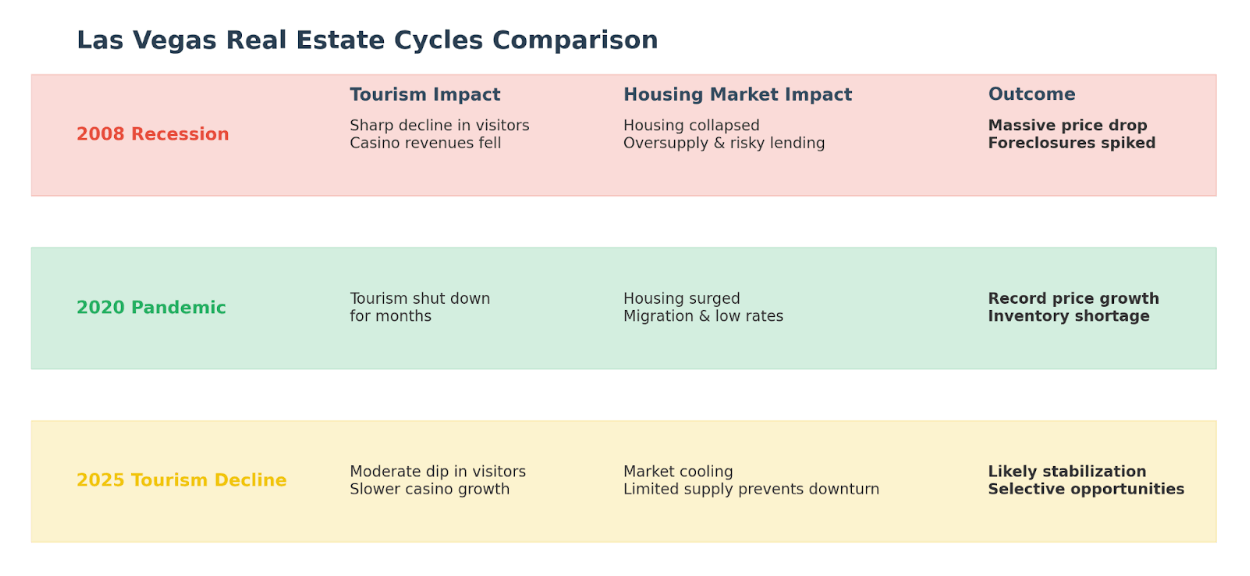

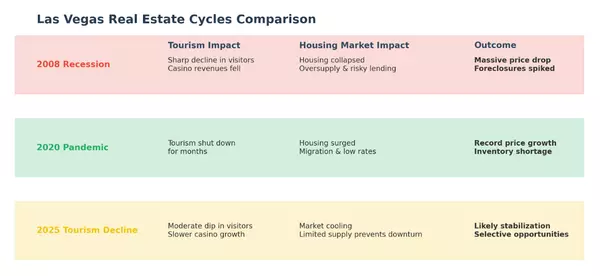

📌 Let’s look at history:

-

2008 Recession: Tourism dropped sharply, but the housing crash was caused by overleveraged buyers and oversupply, not visitors.

-

2020 Pandemic: Tourism evaporated—but housing boomed thanks to low interest rates, work-from-home migration, and investor interest.

In short: Vegas housing responds to macroeconomic and local forces, not just the Strip.

🔍 Why 2025 Is Different

Today’s dip in visitor volume isn’t a crash—it’s a moderate adjustment. Meanwhile, several positive fundamentals are still in place:

-

Sports & Entertainment: The Raiders, Formula 1, and major concerts continue drawing global attention

-

In-Migration: Californians, remote workers, and retirees are still relocating

-

Housing Supply: Inventory remains constrained, preventing a repeat of past oversupply cycles

-

Diverse Economy: Logistics, healthcare, and tech jobs are helping stabilize housing demand

💼 What This Means for Investors and Buyers

If you’ve been priced out or waiting for a “dip,” this may be your moment to act.

💸 Benefits of Acting Now:

-

More pricing flexibility as sellers adjust expectations

-

Less competition from buyers who are hesitant

-

Rental demand remains strong, especially in suburban markets like Henderson and North Las Vegas

-

Lower risk of overpaying compared to 2021–2022 frenzy levels

✅ Strategic Moves in Today’s Market

-

First-time buyers: Lock in now and refinance later

-

Investors: Focus on long-term rental income and value-add deals

-

Move-up buyers: Use this window to upgrade with negotiating power

-

Multifamily buyers: Target Class B/C units where tourism slowdowns don’t impact tenant demand

🙋♀️

FAQs: 2025 Las Vegas Tourism and Real Estate

1. Is tourism really down in 2025?

Yes, but only modestly. Visitor numbers are below the 2022–2023 peak, but the dip is manageable and not impacting the economy city-wide.

2. Does a tourism dip hurt housing prices?

Not directly. Housing is more impacted by interest rates, migration, and local supply/demand dynamics.

3. Is now a good time to buy in Vegas?

Yes—cooling demand creates more negotiating power, and the long-term outlook remains strong.

4. Will rental demand be affected?

No. Population-driven demand continues to support strong rental markets, especially in the suburbs and near job centers.

5. What types of properties are safe right now?

Multifamily, SFRs in high-absorption neighborhoods, and condos near live-work corridors all perform well in periods like this.

6. Should I wait for a bigger crash?

Unlikely. Las Vegas doesn’t have the oversupply conditions seen in past crashes, and fundamentals remain sound.

Categories

Recent Posts

GET MORE INFORMATION