Renters Seek Larger Homes & Longer Tenancies: Why Las Vegas Is a Top Market for Single-Family Rentals

Renters Opt for Larger Homes and Longer Tenancies: A Boon for Single-Family Rental Investors

Why Single-Family Rentals Are Thriving in Today’s Real Estate Market

The single-family rental (SFR) market is experiencing unprecedented growth as renters increasingly prioritize larger homes and longer tenancies. With homeownership affordability at historic lows and remote work reshaping housing needs, SFR investors are well-positioned to benefit from shifting renter preferences.

For real estate investors, the current market dynamics present an opportunity to secure stable cash flow, reduce vacancy risks, and achieve long-term appreciation—particularly in high-demand markets like Las Vegas.

Longer Tenancies: A Growing Trend in the Rental Market

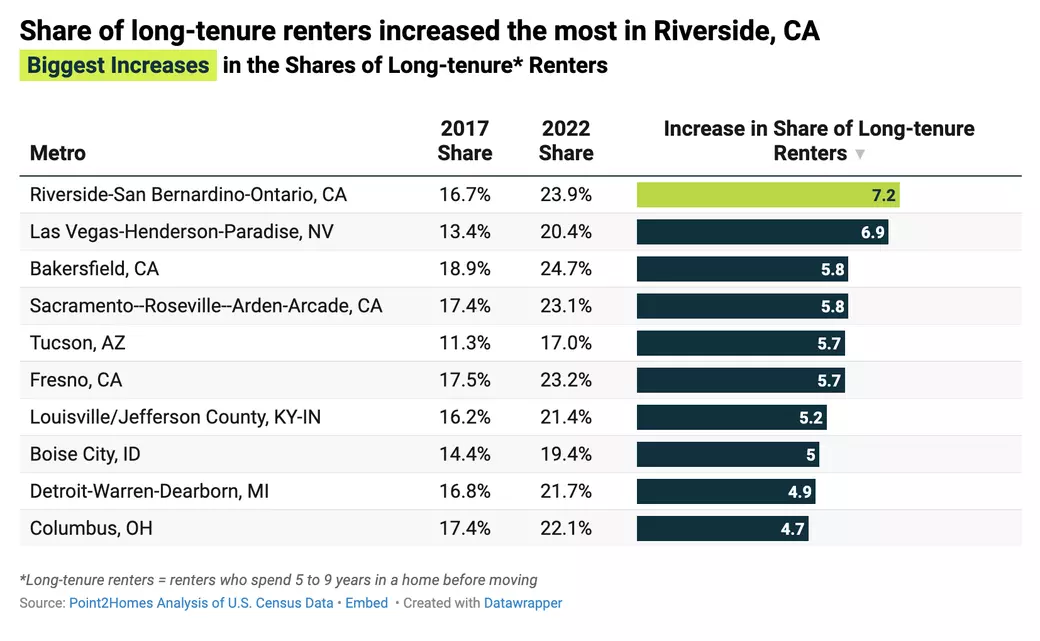

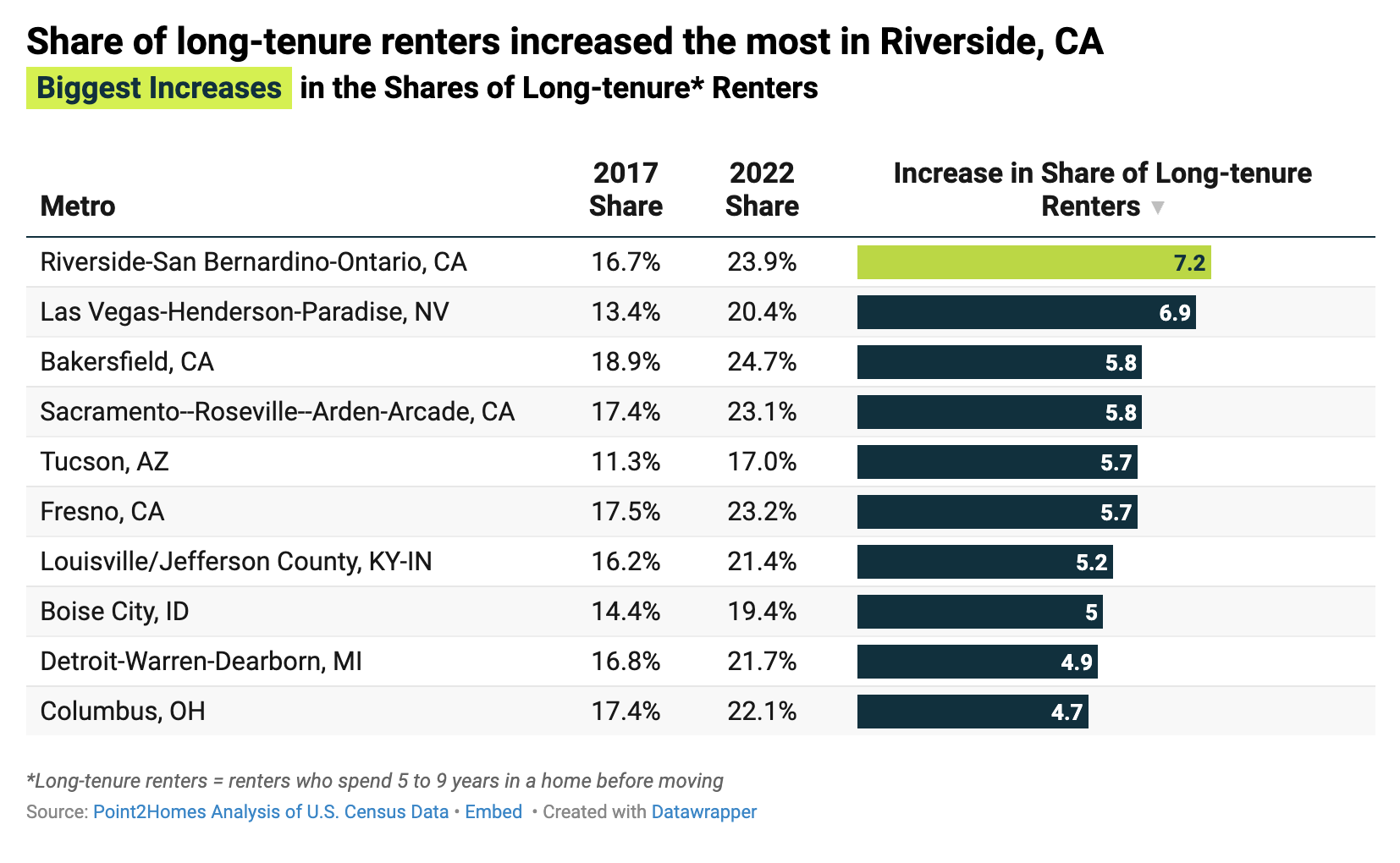

A recent Point2Homes research report highlights a significant shift toward longer tenancies:

• The share of renters who stay five to nine years increased by 2 percentage points.

• Renters staying over a decade rose by 2.7 percentage points.

• Short-term renters (moving after one year) declined by 4.5 percentage points over the past five years.

Top Cities for Rental Stability:

• Bakersfield, CA

• Tucson, AZ

• Omaha, NE

Why Las Vegas Outshines Other Mid-Sized Cities

While Bakersfield, Tucson, and Omaha show strong rental stability, Las Vegas offers additional advantages that elevate it as a more attractive investment market:

1. Major Metropolitan Status:

• Las Vegas offers big-city amenities, global connectivity, and a diverse economy.

• The city’s size and economic reach provide greater rental demand than smaller markets.

2. Diversified Economy:

• Las Vegas’ job market spans technology, logistics, healthcare, and professional services.

• Unlike Bakersfield’s reliance on agriculture, Tucson’s university-driven economy, or Omaha’s slower growth, Las Vegas offers resilience and investment stability.

3. Strong In-Migration Trends:

• With no state income tax and affordable housing, Las Vegas attracts migrants from high-cost states like California.

• This influx of residents boosts rental demand, ensuring consistent cash flow for investors.

Millennials Drive Demand for Single-Family Rentals

A key driver of the shift to SFRs is millennials, many of whom have yet to transition to homeownership:

• Limited housing inventory and rising mortgage rates make buying a home difficult.

• The financial burden of moving, including lease costs, security deposits, and moving expenses, incentivizes renters to stay longer.

• Remote work trends push renters toward larger homes that support a hybrid work lifestyle.

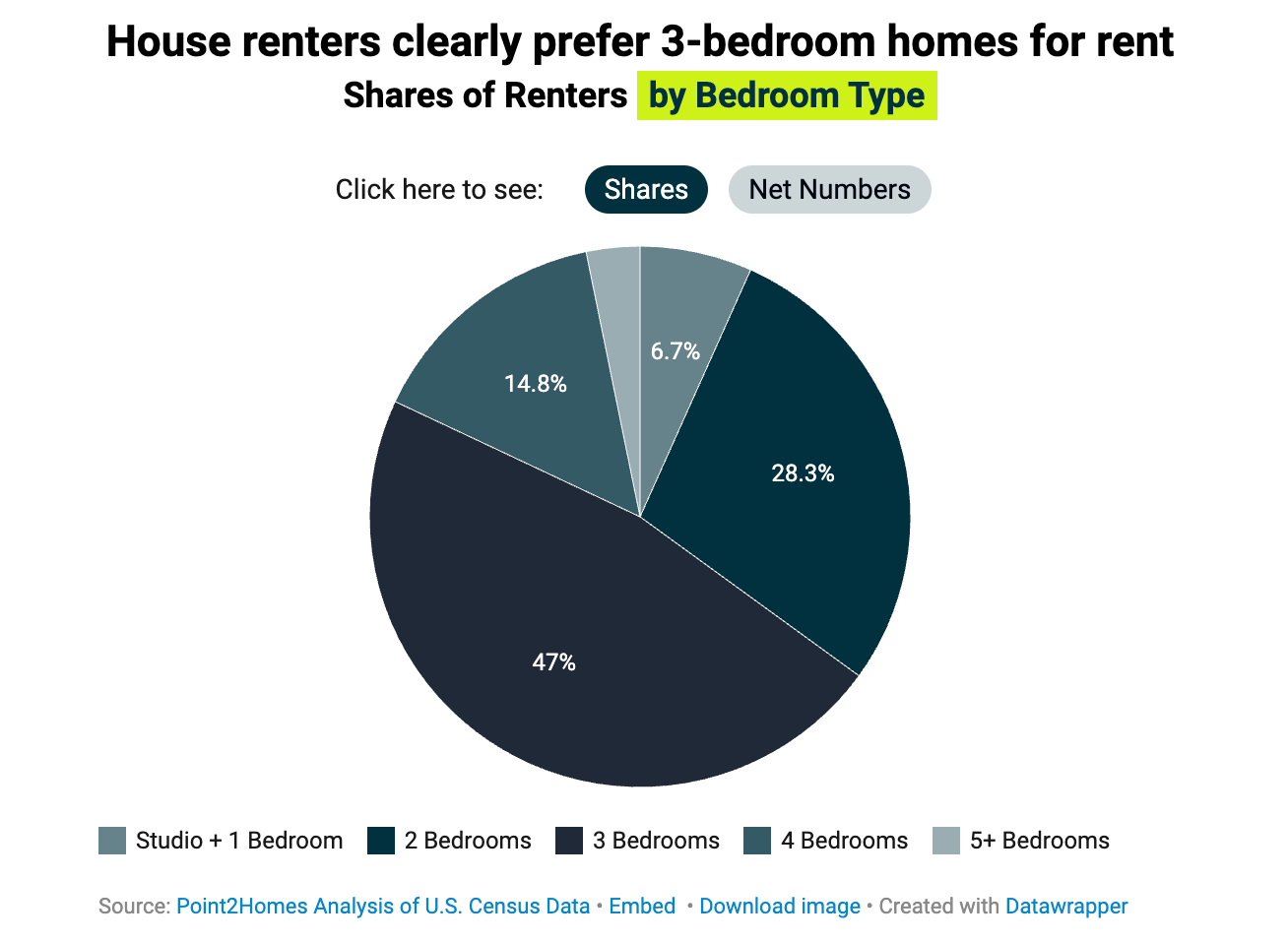

Larger Homes in High Demand: The Case for Three-Bedroom Rentals

The preference for larger homes is growing, with three-bedroom units being particularly popular among families and remote workers:

• Nearly 50% of SFR renters prefer three-bedroom homes, while only 10% choose one-bedroom units.

• Approximately 7 million renters live in three-bedroom rental homes, compared to 4 million in two-bedroom units.

Top Markets for Three-Bedroom Rentals:

• Los Angeles

• Dallas

• Philadelphia

Why Las Vegas Beats Other Major Markets for SFR Investments

1. Affordable Entry Point for Investors:

• Las Vegas offers a lower cost per square foot compared to Los Angeles, enabling investors to acquire properties at better value.

• While Dallas is also affordable, Las Vegas’ tax benefits (no state income tax) enhance investment returns.

• Although Philadelphia has lower home prices, it lacks Las Vegas’ growth, tax benefits, and rental demand.

2. Favorable Market Conditions:

• Lower maintenance costs: Thanks to newer housing stock in Las Vegas.

• Higher appreciation potential: Due to population growth and strong rental demand.

• Stable rental yields: Attract long-term tenants seeking affordability and lifestyle benefits.

How Remote Work Boosts Demand for Larger Rentals

The remote work revolution has led many professionals to seek larger homes, allowing for dedicated office space:

• Suburban and secondary markets, like Las Vegas, benefit from migration trends as renters leave dense urban centers.

• Renters are willing to pay premiums for spacious living environments that support work-from-home setups.

Key Takeaways for Single-Family Rental Investors

For real estate investors, these market trends present a clear opportunity:

✔ Invest in Three-Bedroom Homes:

• High demand: Especially among families and remote workers.

• Lower tenant turnover: Leads to reduced vacancy risk and more stable cash flow.

✔ Focus on Build-to-Rent Opportunities:

• The build-to-rent sector offers newer properties, lower maintenance costs, and appeal to long-term renters.

• Investors can acquire turnkey rental properties, reducing initial setup time and costs.

✔ Capitalize on Las Vegas’ Market Advantages:

• Global connectivity: Harry Reid International Airport drives tourism, business travel, and rental demand.

• Diverse economy: Creates job stability, supporting steady occupancy rates.

• Tax benefits: No state income tax enhances investment profitability.

Why Las Vegas Is an Investor-Friendly Market

The single-family rental market remains a resilient asset class, offering investors strong returns through longer tenancies, high demand for larger homes, and stable occupancy rates.

Why Choose Las Vegas for SFR Investments?

• Affordable property values with high rental yields.

• Lower competition than Los Angeles and Dallas, with greater appreciation potential.

• Favorable tax environment and robust economic growth.

Las Vegas offers a unique balance of cash flow, affordability, and long-term appreciation, making it one of the most investor-friendly cities in the U.S.

Contact Us Today to learn more about single-family rental opportunities in Las Vegas and maximize your investment strategy!

FAQs: Investing in Single-Family Rentals in Las Vegas

1. Why are single-family rentals (SFRs) in high demand?

SFRs meet growing demand for larger homes, longer tenancies, and remote work flexibility, offering investors stable returns.

2. What makes Las Vegas a good market for SFR investments?

• Affordability and strong rental demand.

• No state income tax, enhancing profitability.

• Diverse economy and global connectivity through Harry Reid International Airport.

3. What types of SFR properties are most attractive to renters?

Three-bedroom homes are especially popular among families and remote workers, providing lower turnover and higher occupancy rates.

Categories

Recent Posts

GET MORE INFORMATION