Have Home Prices Peaked in the Las Vegas Valley? A 2025 Market Outlook for Buyers and Investors

Have Home Prices Peaked in the Las Vegas Valley? A 2025 Market Outlook for Buyers and Investors

2025 Market Outlook for Homebuyers & Real Estate Investors

Published by Hyde Real Estate Group

April 2025

Home Prices Are Still Rising—For Now

Despite national cooling trends, Las Vegas home prices climbed 0.85% in February 2025, marking the strongest month-over-month gain since October, according to Redfin.

“We’re still seeing growth here, so I wouldn’t say we’re at the peak,”

— Cheryl Van Elsis, Redfin Realtor, Las Vegas

Compared to cities like Tampa, FL—where prices fell 6% year-over-year—Las Vegas remains a resilient and affordable market, especially for those relocating from California or looking for strong rental returns.

Why Las Vegas Remains a Strong Market

✅ Affordability vs. West Coast Cities

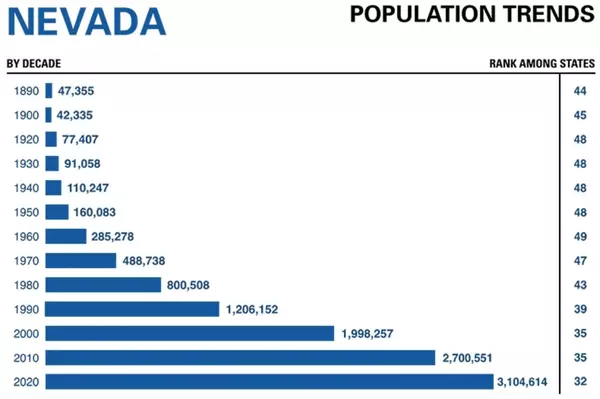

✅ Inflow of New Residents & Investors

✅ Upcoming Sports + Entertainment Developments

✅ Limited Housing Supply Keeps Pressure on Prices

“The sports, entertainment and growth sectors here are driving a lot of professionals to move in,” Van Elsis said. “There are still good opportunities for buyers who are serious.”

What Investors & Buyers Need to Know

As of March 2025:

- 📉 National growth is slowing — Home prices up 5.1% YoY, down from 7.5% in April 2024

- 📈 Vegas still climbing — Driven by population growth and tight supply

- 💰 Mortgage rates have dipped — Now averaging 6.6%, down from 7.2% in January

“Price growth is likely to continue cooling into the spring, but that doesn’t mean buyers should expect major bargains,”

— Sheharyar Bokhari, Redfin Senior Economist

Market Strategy: What Should You Do Right Now?

🏡 If You’re a Buyer:

- Lock in a pre-approval before rates shift again

- Watch for opportunities in underpriced pockets or value-add properties

- Consider neighborhoods near upcoming stadiums, retail, or university expansions

👉 Need help identifying where to buy next?

📩 Schedule your free buyer consultation today »

💼 If You’re an Investor:

- Las Vegas multifamily is outperforming many U.S. metros

- Look for cap rates above 6% with potential for appreciation

- Target properties with strong rental demand (proximity to employment centers or the Strip)

📊 Want a custom investment analysis?

📞 Request a portfolio review here »

🧭 Final Takeaway

Home prices in Las Vegas may be nearing a plateau—but we’re not there yet. While national growth slows, the Valley’s in-migration, limited supply, and development boom continue to support values.

Whether you’re buying your first home or scaling your real estate portfolio, 2025 offers unique windows of opportunity. With the right strategy, it’s still possible to buy smart and build wealth in Southern Nevada.Frequently Asked Questions (FAQs)

1. Have home prices in Las Vegas peaked in 2025?

Not yet. Prices are still rising modestly, with February 2025 showing a 0.85% increase. Although growth is slowing, experts suggest the market hasn’t reached its absolute peak .

2. Why are Las Vegas home prices still increasing?

A tight housing supply, consistent population growth, new developments, and inbound migration from California are all contributing to ongoing price appreciation .

3. Are mortgage rates affecting buyer decisions in 2025?

Yes. Rates fell from 7.2% in January to 6.6% in March, boosting buyer power and encouraging more pre-approvals and property searches .

4. Is it a good time to invest in Las Vegas real estate?

Absolutely. With strong cap rates, growing rental demand, and a healthy economic base, Las Vegas remains a top-performing market for real estate investors in 2025 .

5. Which areas in Las Vegas are best for real estate opportunities?

Look into underpriced or transitional neighborhoods, and areas near upcoming infrastructure like stadiums, university expansions, and Opportunity Zones like the Historic Westside .

6. Should I wait for a housing correction before buying?

Probably not. While national growth is cooling, Las Vegas’s fundamentals remain strong. Delaying might lead to higher mortgage rates or missed investment windows .

Categories

Recent Posts