Inside the $42M Portola Centennial Hills Deal: What It Reveals About Class A Multifamily Values in Las Vegas

What the $42M Sale of Portola Centennial Hills Tells Us About Class A Apartment Values in Las Vegas

Las Vegas just witnessed a landmark transaction in the Class A multifamily space. On March 20, 2025, SB Real Estate Partners (SBREP) acquired the Portola Centennial Hills—a newly built, 143-unit luxury apartment community—for $42 million in an off-market deal.

Located in the highly sought-after Centennial Hills submarket, this acquisition sheds light on current pricing, return expectations, and investment dynamics for high-end multifamily properties in the Las Vegas metro area.

📊 Deal Snapshot: Portola Centennial Hills Key Metrics

|

Metric |

Value |

|---|---|

|

Purchase Price |

$42,000,000 |

|

Units |

143 |

|

Price per Door |

$293,706 |

|

Avg. Rent (2BR) |

$1,625/month |

|

Occupancy |

~95% |

|

Gross Income (Annualized) |

$2,649,372 |

|

Operating Expenses (23%) |

$609,356 |

|

Property Taxes |

$354,080 |

|

Total Expenses |

$963,435 |

|

Net Operating Income (NOI) |

$1,685,937 |

|

Net Cap Rate |

4.01% |

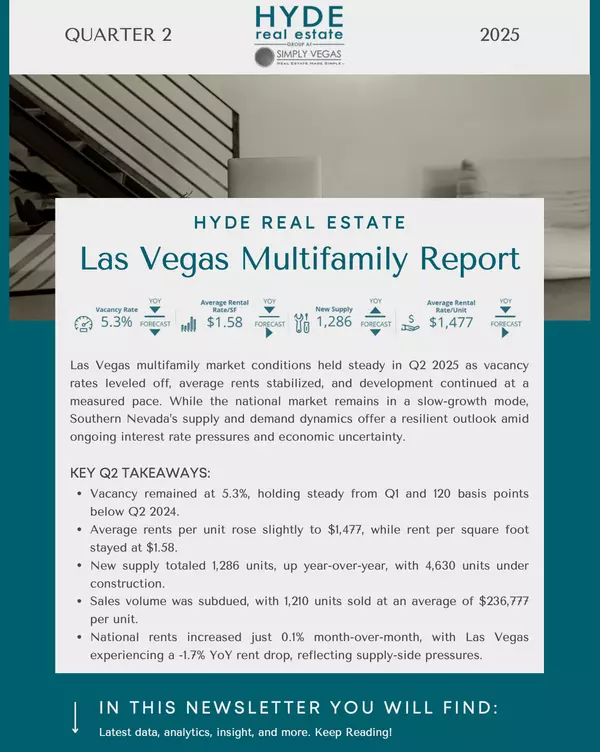

This analysis reveals top-of-market pricing with relatively compressed cap rates, reflecting investor appetite for Class A, low-maintenance assets in premium submarkets.

🏢 Why Class A Assets Still Command Premium Pricing

Though Class A assets often yield lower cap rates than B/C properties, they offer:

-

Lower maintenance and capital needs

-

Higher-income tenant demographics

-

Stability in occupancy and rents

-

Longer tenant retention

In tight submarkets like Centennial Hills—where household incomes exceed $120K and supply is limited—new luxury units offer a strong value proposition to long-term investors and REITs.

📈 Investor Takeaways: What This Sale Tells Us

-

Cap Rates for Class A are ~4.0%

While lower than B/C properties (which may offer 6–8%), investors accept this for reduced risk and scalability.

-

$290K–$300K Per Door Pricing Is the New Benchmark

For institutional-grade, newly built product in high-income submarkets, this is becoming standard.

-

Gross vs. Net Cap Differential

Class A deals may show 6–6.5% gross cap rates, but net cap rates are tighter due to higher taxes and operational cost structure.

-

Low Turnover = Cash Flow Stability

High tenant retention in Class A buildings reduces leasing costs and vacancy risk.

🤔 Frequently Asked Questions (FAQs)

1. Why are investors paying high per-unit prices for Class A properties?

Because they offer long-term stability, minimal capex, and attract higher-income tenants—making them attractive to institutional capital.

2. Is a 4% cap rate too low in this environment?

Not for Class A assets in prime locations. Investors trade yield for risk mitigation and appreciation potential.

3. Are there comparable deals in Las Vegas?

Yes. Recent transactions in Summerlin and Henderson show similar pricing trends for new Class A buildings.

4. How do Class A assets compare to B/C from a management standpoint?

They often require less active management, fewer repairs, and attract more responsible tenants.

5. Is Centennial Hills a top submarket for multifamily?

Yes. It combines limited supply, strong income demographics, and growing demand—all ideal for premium rental housing.

6. What’s the outlook for Class A assets in 2025 and beyond?

As interest rates normalize and rental demand strengthens, Class A will continue to attract institutional capital.

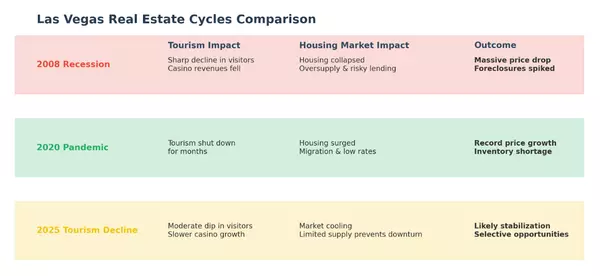

🔚 Final Thoughts: A Blueprint for Premium Multifamily Investing

The sale of Portola Centennial Hills is more than a headline—it’s a signal. Investors are still willing to pay top dollar for quality, stability, and strategic location. With Las Vegas continuing to attract both residents and capital, Class A multifamily assets remain a cornerstone of smart portfolio growth.

Categories

Recent Posts

GET MORE INFORMATION