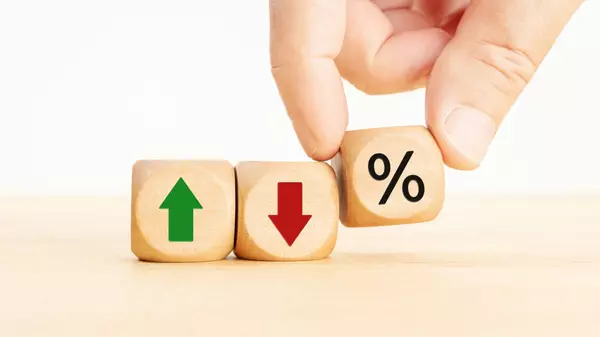

Navigating Multifamily Trends: February 2025 Market Update & Las Vegas Outlook

As we approach the spring season—historically the peak period for multifamily real estate activity—investors are closely examining the current state of the multifamily market. Yardi Matrix’s Multifamily National Report for February 2025 sheds critical insights into national trends, economic factors, and particularly, what this means for investors in the Las Vegas market.

National Overview

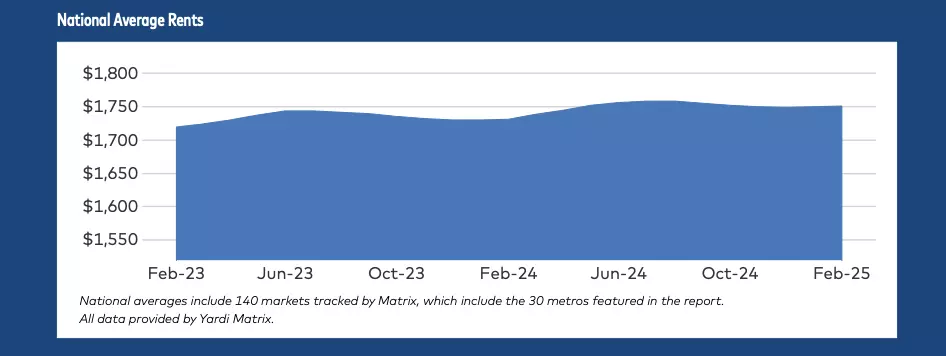

Nationally, multifamily rents remained flat in February, with advertised asking rents averaging $1,751, reflecting a modest $1 increase from the previous month. Year-over-year rent growth stands steady at 1.2%, underscoring market stability despite increasing economic uncertainty, recent layoffs exceeding 170,000—the highest monthly number since the global financial crisis—and lingering impacts from proposed tariff policies.

Multifamily occupancy rates nationwide are holding at 94.5%. However, markets experiencing high supply are seeing declines in occupancy. A wave of new units delivered over the past year is testing absorption rates, particularly in cities with aggressive development.

How Las Vegas Compares

In Las Vegas, the multifamily market demonstrates relative resilience despite broader national economic shifts. Year-over-year rent growth for Las Vegas is currently slightly negative at -0.1%, with projected rent growth forecasted at -0.4% for the remainder of 2025. This indicates a relatively stable market when compared with significant downturns seen in other Sun Belt metros such as Austin (-5.1%), Phoenix (-2.2%), and Denver (-3.1%).

Las Vegas is also maintaining steady occupancy, with rates slightly improving by 0.3%, one of the few positive occupancy growth metros alongside San Francisco and Baltimore. The modest increase underscores sustained demand, even amidst increased supply (3.3% completions as a percentage of total stock).

Investment Outlook for Las Vegas

Given the report's insights, the Las Vegas multifamily market presents a cautiously optimistic scenario for investors:

- Demand Stability: Las Vegas continues to experience stable occupancy levels, suggesting sustained tenant demand. This provides a buffer against significant rent declines.

- Supply Management: The local market's new supply growth is balanced compared to other high-supply markets like Austin (9.2%) or Denver (6.0%), reducing the risk of oversupply and significant rent pressure.

- Economic Indicators: With employment growth at 1.8%, Las Vegas remains economically vibrant, supporting ongoing demand for multifamily units.

Strategic Recommendations

Investors should consider:

- Asset Class Selection: "Renter-by-Necessity" assets in Las Vegas continue to offer greater stability, as evidenced by the market’s performance and current economic uncertainty.

- Cautious Optimism: Investors might capitalize on flat rent trends by acquiring properties at stabilized pricing with potential upside when market conditions improve post-2025.

- Targeted Acquisition: Focus on submarkets within Las Vegas with consistent occupancy and lower new supply to hedge against potential volatility.

In conclusion, while the national multifamily outlook shows signs of caution, the Las Vegas market provides relative stability, making it an attractive market for informed investors seeking opportunities that balance current economic uncertainties with the potential for strategic growth.

Frequently Asked Questions (FAQs)

1. Is 2025 a good year to invest in Las Vegas multifamily real estate?

Yes, 2025 shows strong signs of recovery and opportunity in the Las Vegas multifamily market. Rents are rising, vacancy rates are stabilizing, and investor sentiment is improving, making it a strategic time to invest .

2. Are home prices in Las Vegas expected to fall in 2025?

Home prices in Las Vegas are still rising, although growth is expected to cool. The market remains affordable compared to other metros, and demand is sustained by population growth and limited housing supply .

3. How are tariffs impacting the Las Vegas real estate market?

New tariffs on construction materials are raising building costs, which could slow new developments. This may favor existing properties, boosting their rental value and reducing competition for landlords and investors .

4. What areas in Las Vegas are Opportunity Zones, and why do they matter?

Key Opportunity Zones in Las Vegas include the Historic Westside, East Las Vegas, and parts of Downtown North. These areas benefit from tax incentives and are seeing a surge in multifamily development, making them attractive for investors .

5. What are the rental trends in Las Vegas for 2025?

Unlike many U.S. cities, Las Vegas is experiencing rent increases, with a 2.9% year-over-year growth. This is driven by strong demand, limited new supply, and migration from higher-cost states .

6. How does Las Vegas compare to other West Coast cities in terms of affordability?

Las Vegas remains significantly more affordable than cities like San Francisco and Los Angeles. It’s a leading West Coast market for renters and investors, thanks to lower income requirements for rent and a newer housing inventory .

Categories

Recent Posts

GET MORE INFORMATION