Las Vegas Multifamily Market: A Strong Recovery and Investment Opportunity in 2025

Las Vegas Multifamily Market: A Strong Recovery and Investment Opportunity in 2025

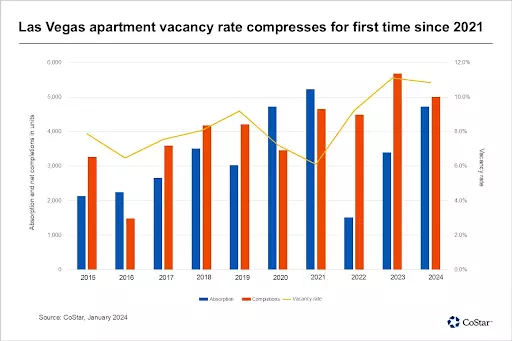

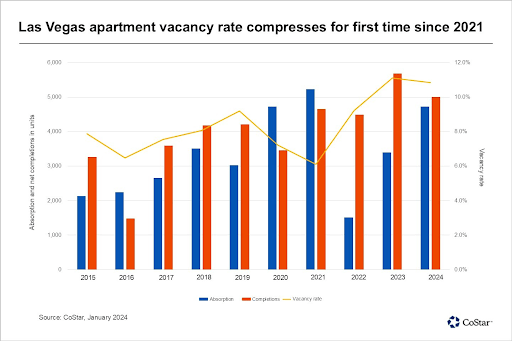

The Las Vegas multifamily market has staged a remarkable recovery after experiencing significant challenges from 2022 to 2023. Following one of the sharpest vacancy increases in the country, 2024 saw stabilization, with nearly 6,000 units absorbed and vacancy rates dropping to 9.8%—the first such decline since 2021. By year-end, rents leveled off, signaling a return to stability and setting the stage for a strong performance in 2025.

If you’re considering real estate investment opportunities, don’t miss our guides on Why Las Vegas is the Best Place to Buy Rental Properties in 2024 and Why Now is the Time to Invest in Las Vegas Income Properties for more in-depth insights into this thriving market.

2025 Las Vegas Multifamily Market Outlook: Stronger Demand, Lower Supply

The forecast for 2025 suggests a robust year for the Las Vegas multifamily market. Two major factors—reduced supply and increasing demand—are expected to drive performance:

•Declining Supply Pressure: New construction starts in 2024 dropped by 50%, leaving only 5,200 units under construction, which represents just 2.7% of total inventory.

•Increasing Demand: High in-migration trends and a growing local economy continue to bolster rental demand.

This supply-demand dynamic positions the Las Vegas multifamily market for strong occupancy rates, increased rents, and excellent returns for investors.

Why Invest in the Las Vegas Multifamily Market?

Las Vegas offers unique advantages for real estate investors, making it a compelling destination for multifamily investments. Here’s why:

1. No State Income Tax and Landlord-Friendly Laws

Nevada is a tax haven for property investors, offering no state income tax and regulations that favor landlords. These policies ensure better protection for property owners while maximizing returns.

2. High Demand Driven by Population Growth

Las Vegas continues to experience rapid population growth, fueled by migration from high-cost states like California. This trend supports consistent demand for rental housing and reduces vacancy risk for multifamily properties.

3. Affordable Entry with Strong CAP Rates

Compared to major metropolitan areas, Las Vegas offers an affordable entry point for investors with higher CAP rates, translating to better long-term profitability.

4. A Diversified and Thriving Economy

No longer reliant solely on tourism and hospitality, Las Vegas has expanded into industries like tech, healthcare, and professional services. These sectors contribute to employment growth, increasing the need for rental housing.

Key Metrics Driving Investment Decisions in 2025

Here’s a snapshot of the Las Vegas multifamily market’s vital metrics as of 2025:

Metric Value Trend

Vacancy Rate 9.8% Decreasing

Units Under Construction 5,200 (2.7% of inventory) Lower Supply

Rent Growth Stabilizing with Positive Projections Improving

New Construction Starts 50% decline (2024) Limited Supply

These factors create a favorable environment for long-term investments, particularly in stabilized assets and value-add opportunities.

For more data on the Las Vegas real estate market’s broader dynamics, check out our articles on Why Las Vegas is the Best Place to Buy Rental Properties in 2024 and Why Now is the Time to Invest in Las Vegas Income Properties.

Investment Opportunities in the Las Vegas Multifamily Market

Las Vegas offers various multifamily investment options, tailored to different strategies:

1.Stabilized Cash-Flowing Properties

Properties with high occupancy rates offer reliable monthly income for conservative investors.

2.Value-Add Multifamily Deals

Older buildings that can be renovated provide an opportunity to improve rents and asset value.

3.New Development Partnerships

For investors with a longer time horizon, participating in new developments allows access to modern units and higher rental premiums.

The Competitive Edge of the Las Vegas Market

Unlike many other real estate markets, Las Vegas stands out due to its affordability, economic diversification, and investor-friendly environment. For those looking to capitalize on a market with significant growth potential, the time to act is now.

Pro Tips for Multifamily Investors in 2025

•Focus on neighborhoods with high employment growth.

•Target properties near amenities and public transportation.

•Partner with local experts to access exclusive deals.

FAQs About the Las Vegas Multifamily Market

1. What makes Las Vegas a top choice for multifamily investments?

Las Vegas offers affordable entry points, a growing economy, strong population growth, and favorable tax laws that maximize investor returns.

2. Are rental rates expected to increase in 2025?

Yes, rental rates are expected to grow due to lower supply pressure and higher demand from continued migration and economic expansion.

3. What is the vacancy rate for multifamily properties in Las Vegas?

As of 2024, the vacancy rate is 9.8%, marking the first decline since 2021. This trend is expected to continue into 2025.

4. Is it a good time to invest in Las Vegas real estate?

Yes, 2025 presents a prime opportunity due to tightening supply, increasing demand, and attractive market conditions for both stabilized and value-add investments.

5. How does Las Vegas compare to other real estate markets?

Las Vegas stands out with its higher CAP rates, lower property costs, and landlord-friendly regulations, offering better overall returns.

6. Which areas in Las Vegas are best for multifamily investments?

Neighborhoods with proximity to tech hubs, healthcare facilities, and public transit systems are particularly attractive for multifamily investments.

Why Las Vegas is the Multifamily Market to Watch in 2025

The Las Vegas multifamily market presents a unique opportunity for real estate investors in 2025. With declining supply, strong demand, and a diversified economy, the city offers the ideal conditions for robust returns on investment.

If you’re ready to explore stabilized cash-flowing assets or seek value-add deals, now is the time to act. Contact us today to gain access to exclusive on- and off-market opportunities in this dynamic market.

Categories

Recent Posts

GET MORE INFORMATION