How Las Vegas Compares to the U.S. Multifamily Market

How Las Vegas Compares to the U.S. Multifamily Market

Las Vegas Multifamily Market 2025: Opportunities and Trends for Investors

The U.S. multifamily market is kicking off 2025 with a fresh surge of momentum, breaking a six-month decline in rent growth and maintaining strong apartment demand despite high interest rates and an influx of new supply. Among the nation’s markets, Las Vegas shines as a dynamic investment landscape, offering a unique blend of affordability, growth potential, and economic stability. But how does it stack up against national trends, and what investment opportunities does it offer?

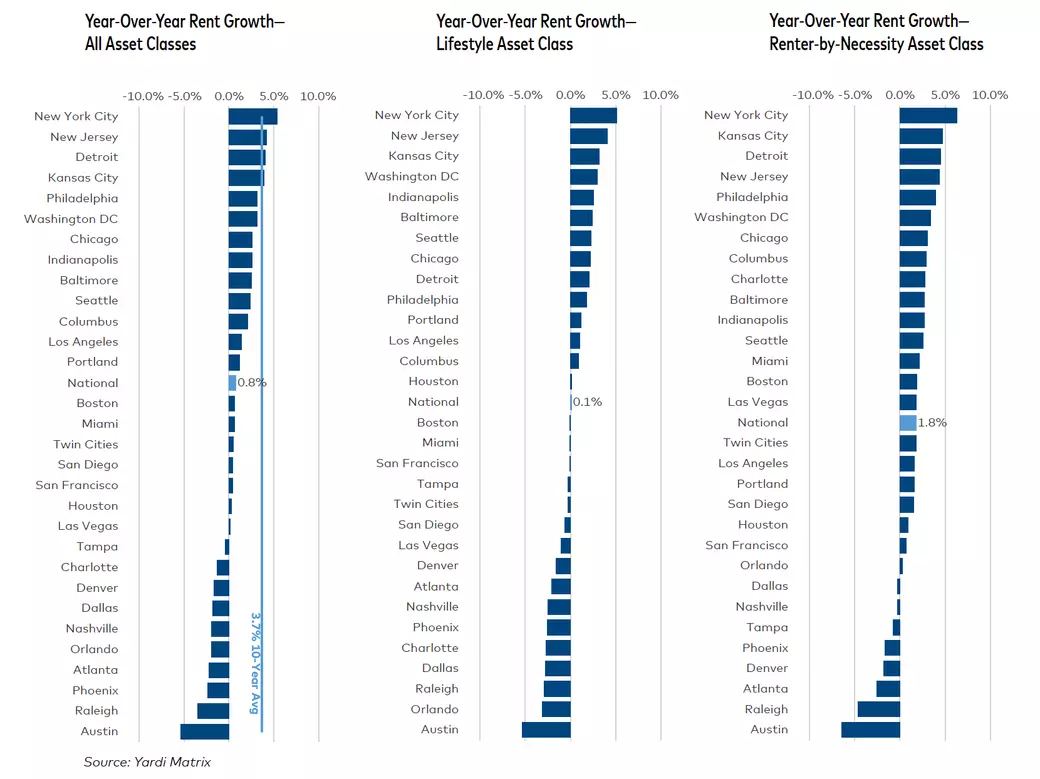

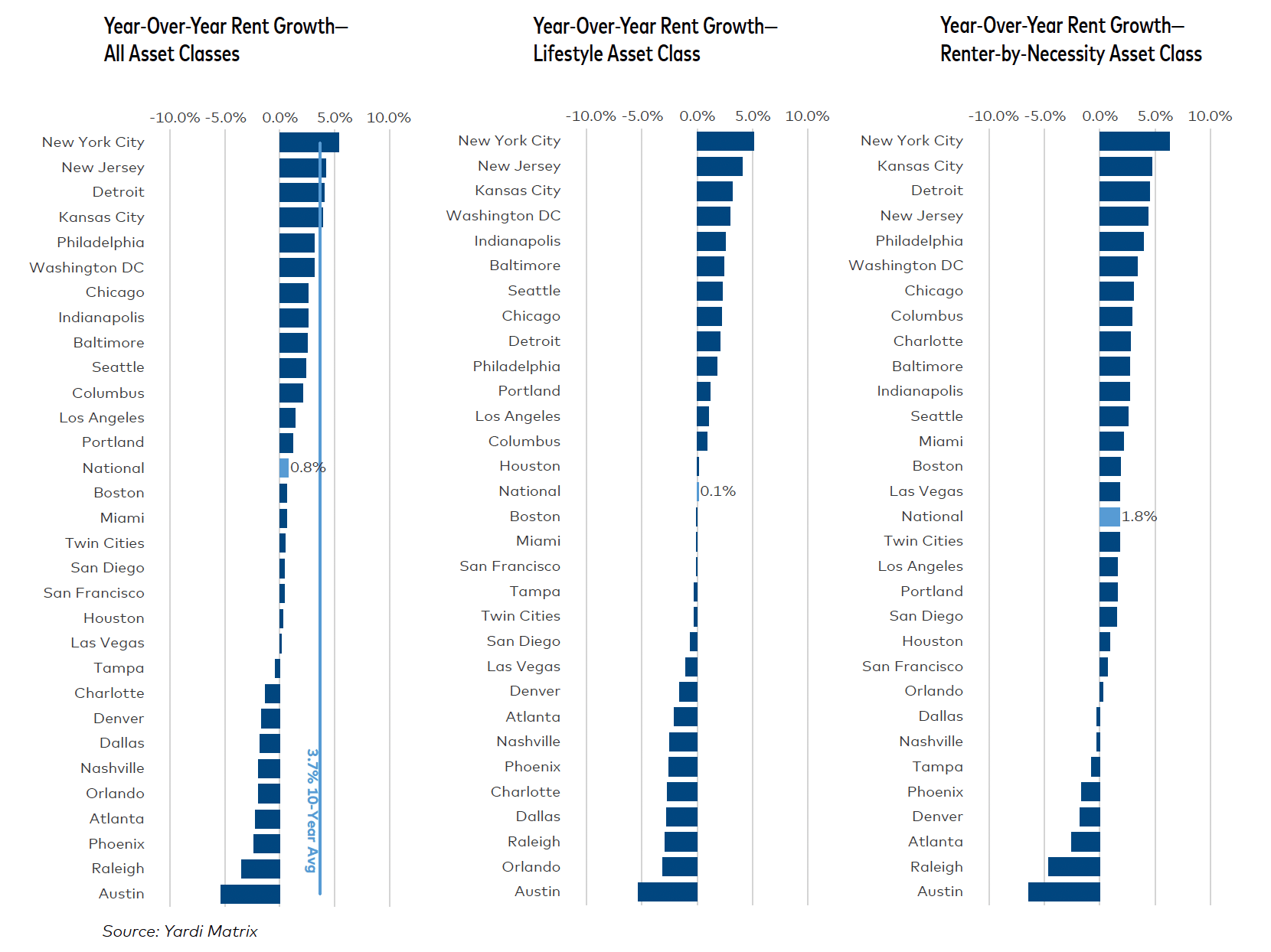

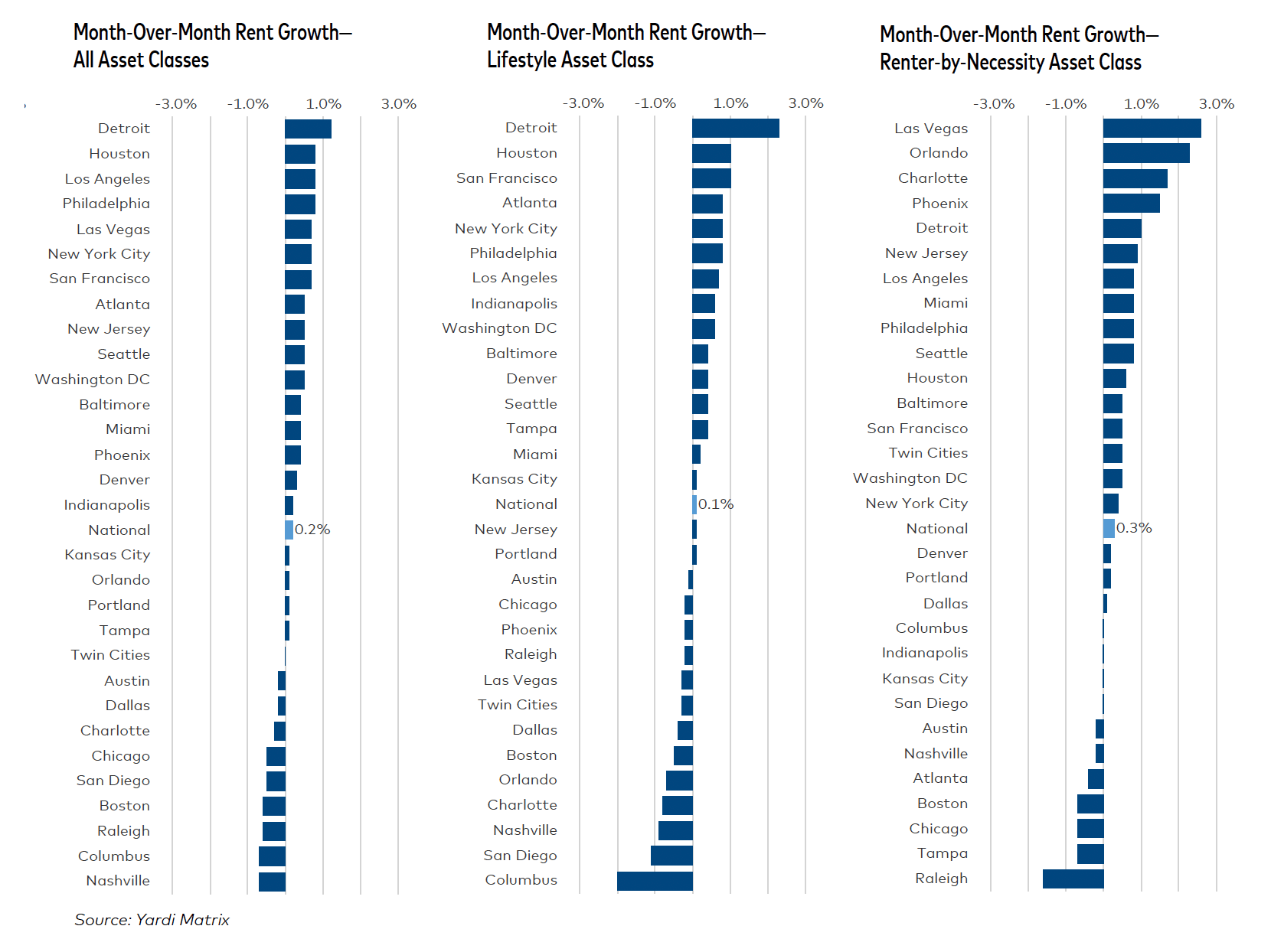

Multifamily Rent Growth: National vs. Las Vegas

National Market Trends:

• Average U.S. Rent: Increased by $3 to $1,746 in January 2025.

• Year-over-Year (YoY) Rent Growth: 0.8%, with strength in the Northeast and Midwest, led by:

• New York: 5.4%

• New Jersey: 4.2%

• Detroit: 4.1%

• Sun Belt Market Declines:

• Austin: -5.4%

• Raleigh: -3.5%

• Phoenix: -2.4%

Las Vegas Performance:

• Minimal Rent Growth: 0.1% YoY, placing Las Vegas mid-range compared to national trends.

• Forecast for 2025: Expected 1.0% growth, reflecting modest market expectations.

• Impact of New Supply: Added 3.6% of new inventory in the last 12 months, contributing to flat rent growth.

Despite slower rent growth, Las Vegas remains an investor favorite due to its affordability compared to coastal metros, steady job growth (2.3% YoY), and a diverse rental demand driven by residents and new businesses.

Understanding the Two Key Multifamily Investment Classes

1. Lifestyle Asset Class (Renters by Choice)

• Target Market: Tenants who could buy but choose to rent for convenience.

• Property Type: Luxury apartments, high-rise communities, and amenity-rich properties in prime locations.

• National Performance: Flat rent growth at 0.1% YoY, showing weak pricing power.

Las Vegas Impact:

The Lifestyle segment in Las Vegas is struggling due to:

• Increased new supply

• Stagnant rent growth

• Declining occupancy rates

Investors in Class A properties should focus on long-term stability rather than quick appreciation.

2. Renter-by-Necessity Asset Class (Affordable Housing Demand)

• Target Market: Working-class tenants who cannot afford homeownership.

• Property Type: Older, well-maintained properties offering affordable rents.

• National Performance: Stronger rent growth at 1.8% YoY, outperforming Lifestyle properties.

Las Vegas Impact:

The Renter-by-Necessity segment is a solid investment in Las Vegas, offering:

• Stable demand

• High occupancy rates

• Resilient cash flow

Key Takeaway for Investors:

• Class A/Lifestyle Assets: May face oversupply challenges and slow rent growth.

• Class B and C (Renter-by-Necessity) Assets: Provide greater stability, strong tenant retention, and consistent cash flow.

Las Vegas Occupancy & Demand: The Bigger Picture

• National Apartment Occupancy: Dropped to 94.5% in December 2024, the lowest in a decade, due to new supply.

• Las Vegas Occupancy Rates: Slightly above national averages, but increased competition is pushing higher concessions to attract tenants.

Investor Strategy:

• Focus on tenant retention: To maintain cash flow resilience.

• Set realistic rent growth expectations: Especially in Class A properties.

• Target the right asset class: Workforce housing offers better stability.

Why Las Vegas Remains an Attractive Investment Market

Despite modest rent growth and rising supply, Las Vegas presents long-term investment advantages, including:

1. Affordability Advantage:

• Lower acquisition costs compared to coastal cities like Los Angeles and San Francisco.

• Competitive rental yields, attracting cash flow-focused investors.

2. Steady Job Growth:

• 2.3% YoY employment growth drives sustained rental demand.

3. Economic Diversification:

• The Las Vegas economy is expanding beyond gaming, with investments in tech, healthcare, and logistics.

What’s Next for Investors in Las Vegas?

The Las Vegas multifamily market is evolving, balancing:

• Slow rent growth

• New supply pressures

• Steady demand from workforce renters

Investor Focus:

• Renter-by-Necessity properties: These Class B/C assets offer stable returns.

• Prioritize cash flow over appreciation: Given lower rent growth projections, choose high-occupancy, well-managed properties.

• Adopt a long-term outlook: Las Vegas remains one of the most affordable Sun Belt markets, making it an attractive option for patient, value-driven investors.

Ready to Explore Multifamily Investment Opportunities in Las Vegas? Contact Us Today!

FAQs: Investing in the Las Vegas Multifamily Market

1. How does Las Vegas compare to the national multifamily market in 2025?

Las Vegas offers affordability, steady job growth, and economic diversification, balancing modest rent growth with strong investment potential.

2. Which multifamily asset class performs best in Las Vegas?

Renter-by-Necessity (Class B/C) properties provide greater stability and consistent cash flow compared to Lifestyle (Class A) assets.

3. Is Las Vegas a good market for new multifamily investors?

Yes, with lower acquisition costs and high rental demand, Las Vegas is ideal for new investors seeking workforce housing opportunities.

4. What are the risks of investing in Class A multifamily properties in Las Vegas?

Oversupply, slow rent growth, and higher vacancy rates may affect Class A properties, requiring long-term strategies.

5. How does new supply affect the Las Vegas rental market?

New apartment inventory contributes to flat rent growth, but Class B/C assets remain less impacted due to consistent demand.

6. What strategies can help maximize returns in the Las Vegas multifamily market?

Focus on tenant retention, realistic rent growth projections, and investing in workforce housing to enhance cash flow stability.

Categories

Recent Posts

GET MORE INFORMATION