Opportunity Zones 2.0: Fueling Multifamily Development in Las Vegas

Apartments in Designated Low-Income Areas Are Getting Built at More Than Twice the National Rate—And Las Vegas is No Exception

As the 2026 expiration date looms for the Opportunity Zone tax program introduced in 2017, investors and developers across the country—and especially here in the Greater Las Vegas area—are rallying behind a renewed push to extend or enhance the legislation. Branded by many as Opportunity Zones 2.0, this next phase of the program aims to build on a tax incentive that has already spurred transformative growth in some of our city’s most underserved neighborhoods.

What Are Opportunity Zones?

Originally passed as part of the Tax Cuts and Jobs Act of 2017, the Opportunity Zone (OZ) program was created to catalyze long-term investments in nearly 8,800 economically distressed census tracts. Investors who redirect capital gains into qualified OZ funds can defer, reduce, and—in some cases—eliminate federal tax obligations.

The strategy? Use the lure of tax savings to funnel private capital into areas that need it most. And in the case of multifamily housing, it’s working.

🧭 Want to know where these zones are? Explore the Nevada Opportunity Zone Map

📜 Full list of zones by census tract available through the IRS

Why It Matters for Las Vegas

In Las Vegas, where affordable housing continues to be a pressing issue, Opportunity Zones have emerged as a key development lever. Many of our city’s designated OZs include historically underinvested areas such as:

- The Historic Westside

- Portions of East Las Vegas and Sunrise Manor

- Downtown North, encompassing areas near Fremont Street and the expanding Symphony Park corridor

These neighborhoods have seen an influx of interest from developers and investors who are now delivering much-needed multifamily units with modern amenities, improved walkability, and access to transit.

Local Impact at a Glance

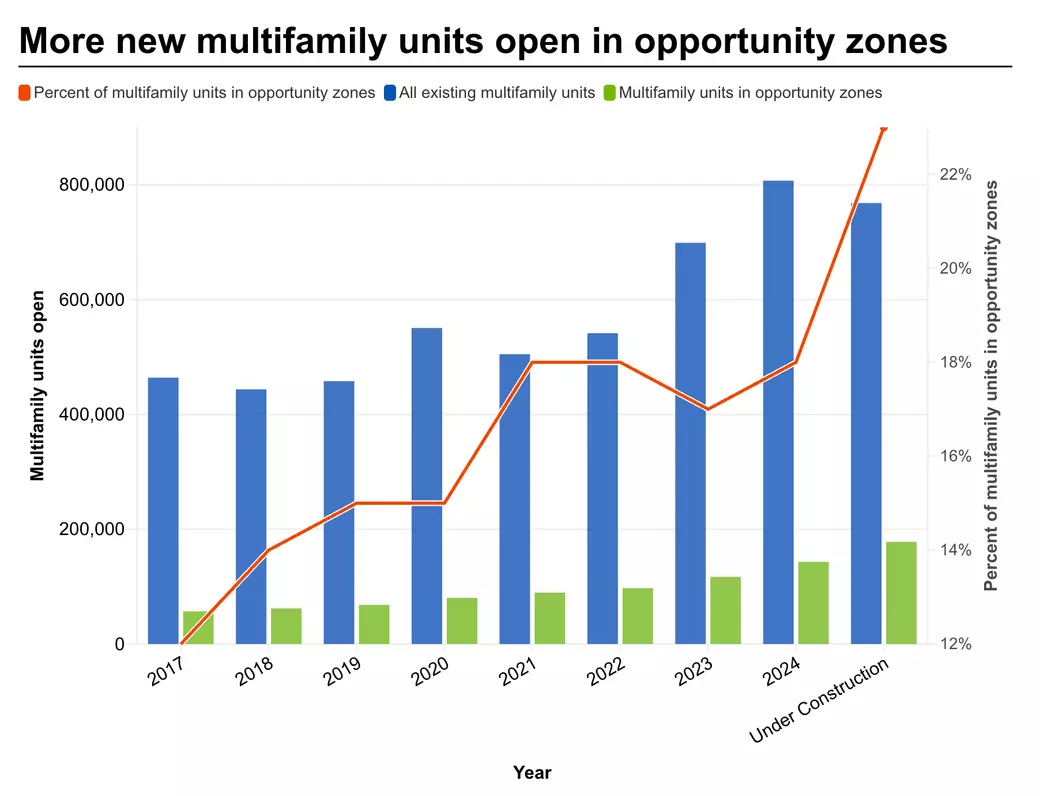

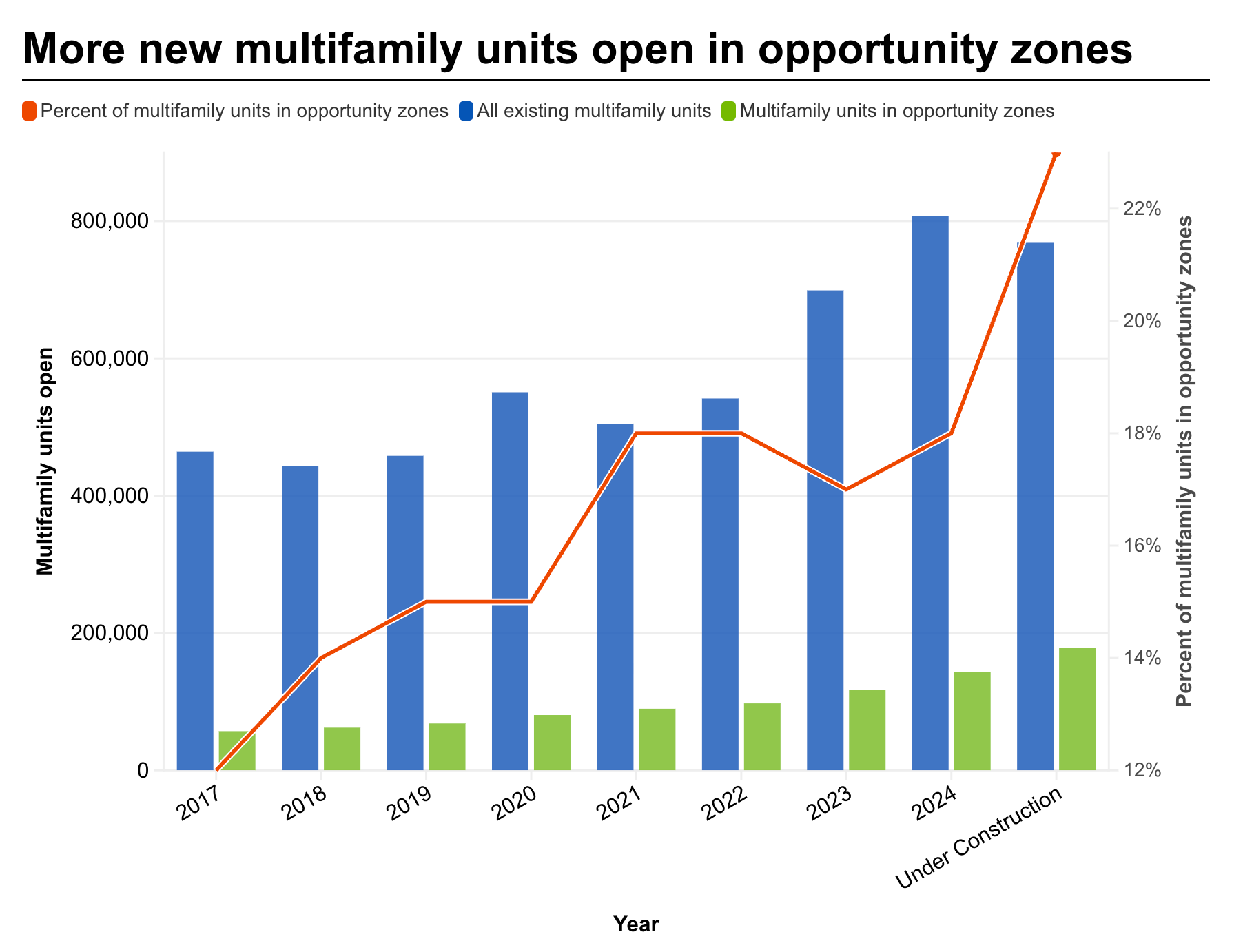

Nationally, new apartment openings in Opportunity Zones rose 151% from 2017 to 2024, according to CoStar. Las Vegas has mirrored this trend:

- OZ-funded projects have helped bridge the gap between market demand and the city’s lagging affordable housing inventory.

- Developers in Las Vegas are actively integrating housing with community-building features, including co-working spaces, retail amenities, and parks.

While Los Angeles saw high-profile openings like the 296-unit Jasper project and SoLa Impact’s SoLa Triple Main, Las Vegas has experienced a quieter but still substantial boom. Mixed-use and multifamily projects in Opportunity Zones are gaining steam due to both tax incentives and demand for better housing stock in rapidly gentrifying areas.

The Case for Opportunity Zones 2.0

Proponents of the program are now calling for an improved and extended version—Opportunity Zones 2.0—to:

- Make the program permanent

- Introduce a rolling deferral window to replace fixed sunset deadlines

- Broaden eligibility to include other income brackets or types of tax benefits

- Encourage participation from rural communities

Industry experts argue that the program has demonstrated a strong return on investment, both socially and financially. According to Novogradac & Co., as of late 2024, there were over 2,000 qualified opportunity zone funds nationwide, with more than $40 billion raised, most of which targeted multifamily housing.

In Nevada, these funds are contributing to everything from downtown revitalization to infill projects in suburban areas close to major transit lines.

What’s Next for Las Vegas Investors?

With the possibility of OZs expiring after 2026, local investors and developers should act now to take full advantage of the current framework. For those holding appreciated assets—such as real estate, stocks, or a business sale—OZ funds can be a powerful tax strategy and a meaningful impact investment.

Local organizations and planning officials are already discussing how to keep momentum going. The hope is that Opportunity Zones 2.0 will include tweaks that make participation easier and the benefits even more inclusive.

How to Get Started

If you’re considering investing in Opportunity Zones in Las Vegas:

- Review Nevada’s Opportunity Zone Inventory

Browse the interactive map and resources to identify qualified tracts. - Consult with a Qualified Fund Manager or Advisor

There are numerous qualified OZ funds actively accepting investments for Nevada-based projects. - Look for Strategic Properties

Work with a real estate team that understands where appreciation and community development overlap.

Final Thoughts

Opportunity Zones have already transformed how we approach redevelopment in Southern Nevada. With the next evolution of the program potentially on the horizon, now is the time to consider how this federal incentive can support your investment goals while doing good for the community.

If you’re an investor, developer, or landowner curious about how Opportunity Zones could factor into your portfolio strategy, contact us today. The window is closing, but the opportunity is just beginning.

📞 Call Catherine Hyde at 702-408-2289

Frequently Asked Questions (FAQs)

1. What are Opportunity Zones and why were they created?

Opportunity Zones were introduced in the 2017 Tax Cuts and Jobs Act to encourage investment in economically distressed areas. Investors receive tax benefits by reinvesting capital gains into these zones .

2. How is Las Vegas benefiting from Opportunity Zones?

Las Vegas is experiencing multifamily growth in Opportunity Zones like the Historic Westside, East Las Vegas, and Downtown North. These areas are seeing new developments that improve housing and amenities .

3. What is Opportunity Zones 2.0?

Opportunity Zones 2.0 is a proposed expansion of the original program. Advocates want to make it permanent, introduce rolling deadlines, and expand eligibility for more investors and regions .

4. Why are Opportunity Zones important for multifamily housing?

They drive private investment into underserved neighborhoods, creating more affordable multifamily units while offering investors tax deferrals, reductions, and exclusions on gains .

5. What tax benefits do investors get from OZs?

Investors can defer capital gains, reduce taxable gains after holding investments for five years, and potentially eliminate capital gains tax on new OZ investments held for at least 10 years .

6. How can I start investing in Las Vegas Opportunity Zones?

Begin by reviewing Nevada’s OZ map, consult with a qualified fund manager, and partner with a real estate team experienced in OZ developments to identify strategic properties .

Categories

Recent Posts

GET MORE INFORMATION